How stable are stablecoins?

April 2022. Reading Time: 10 Minutes. Author: Dilsher Singh Dhingra

Introduction to Stablecoins

Cryptocurrencies have struggled to gain traction for payments by the general population because of the lack of ease of use and price volatility. Trying to pay for coffee with Bitcoin is not easy when the price can jump up or down by 15% in few minutes. As a result, cryptocurrencies are mostly regarded as speculative investments rather than a medium of exchange.

Although cryptocurrencies might not be an ideal payment method for groceries currently, many still believe that the underlying blockchain technology has plenty of potential — especially when it comes to eliminating reliance on centralised financial institutions such as banks and regulators. The speed of fiat bank transactions also comes in for frequent criticism, not to mention the exorbitant fees charged to those who need to send money internationally.

For years, crypto enthusiasts have been seeking a compromise — a digital currency that minimizes volatility, is practical for daily use, and addresses fiat industry flaws that hit consumers in the wallet. Stablecoins have been touted as the answer, and they have exploded in popularity over recent years.

In this article, we are going to provide a brief overview on what stablecoins are and how they work.

Stablecoins explained

So how do stablecoins work? Well, the value of these cryptocurrencies is pegged to another asset. Usually, this is a fiat currency such as the US Dollar, Euro, or British Pound. As a result, one unit of the stablecoin may be equal to $1, €1 or £1.

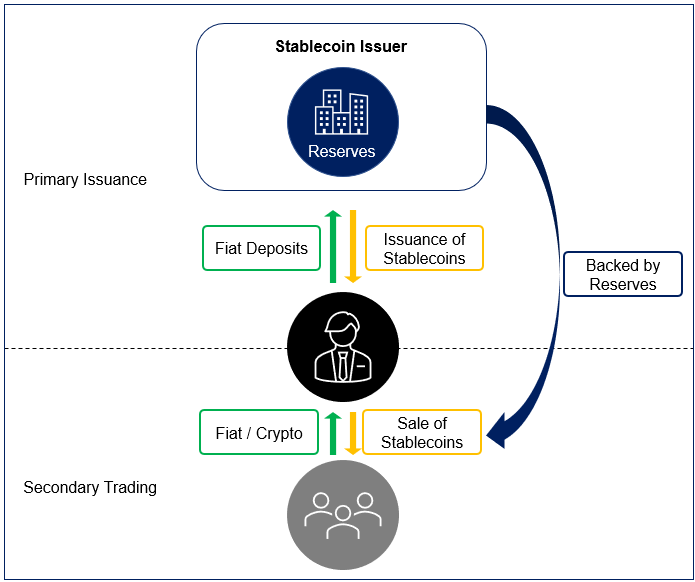

Stability is achieved through collateralization — with a reserve fund ensuring that every stablecoin is backed by an equivalent amount of the pegged asset. So, if there are two million units of a stablecoin pegged to the US Dollar out in circulation, there should be US$2 million deposited in a bank account.

The USDC stablecoin, for example, is backed by US Dollar-denominated assets of at least equal fair value to the USDC in circulation via segregated accounts with US regulated financial institutions. USDC provides comfort to investors by having the accounts and its values verified by an independent accounting firm. Such a type of a stablecoin is referred to as a fiat-collateralised stablecoin.

Source: Jackdaw Capital

Different types of stablecoins

Although they are less common, there are other types of stablecoins that use different types of collateral. There are three other key categories of stablecoins other than fiat-collateralised stablecoins, as follows:

- Commodity-backed stablecoins: These are backed by a commodity like gold and are structured the same way as stablecoins backed by fiat currencies work. Instead of having USD reserves, these own gold. Digix (DGD) is a stablecoin backed by gold that gives investors the ability to invest in the precious metal without the difficulties of transporting and storing it. PAX Gold (PAXG) and Tether Gold (XAUT) are a few other gold-backed stablecoins

- Crypto-backed stablecoins: These are backed by other crypto assets that tend to be volatile, so are overcollateralized to ensure the stablecoins value. For example, a $1 crypto-backed stablecoin may be tied to an underlying crypto asset worth $2, so if the underlying crypto loses value, the stablecoin has a built-in cushion and its price can remain at $1. Havven (HAV) and Wrapped Bitcoin (WBTC) are examples of crypto backed stablecoins

- Algorithmic stablecoins: These do not have any associated assets as collateral and use algorithms to keep the coin’s value from fluctuating too much. If the price of an algorithmic stablecoin is pegged to $1, but the stablecoin rises higher, the algorithm would automatically release more tokens into the supply to bring the price down. If it falls below $1, it will reduce the supply to bring the price back up. The longest-running algorithmic stablecoin is currently Ampleforth (AMPL), which is currently priced at $1.07. An algorithmic stablecoin is a representation of what true decentralization looks like, without any regulatory bodies to maintain or watch over the proceedings, as the code is what is responsible for both the supply as well as the demand, alongside the target price.

Top 10 stablecoins

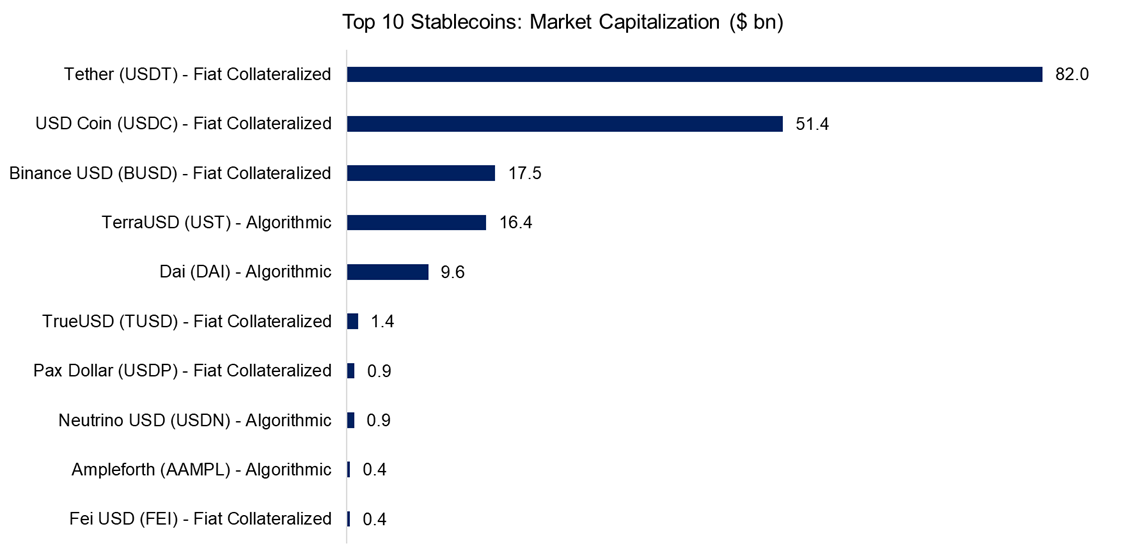

As per the CoinMarketCap database, there are currently 75 stablecoins. Tether (USDT) and USD Coin (USDC) dominate the stablecoins space as measured by market capitalization. Not surprisingly, they both are fiat-collateralised to the US Dollar, i.e. they are backed by an equal amount of US Dollars.

Source: CoinMarketCap (1st April 2022)

Price stability of stablecoins

Critics of stablecoins argue that they undermine what crypto was designed for in the first place: to achieve independence from central banks and fiat currencies.

A bigger concern surrounds collateralization. One of the biggest stablecoin operators, Tether, has faced allegations that it doesn’t have enough dollars in reserve to back the coins it has in circulation — despite saying it is “100% backed” by the US Dollar. The SEC has investigated Tether multiple times, but nothing conclusive has come from these investigations.

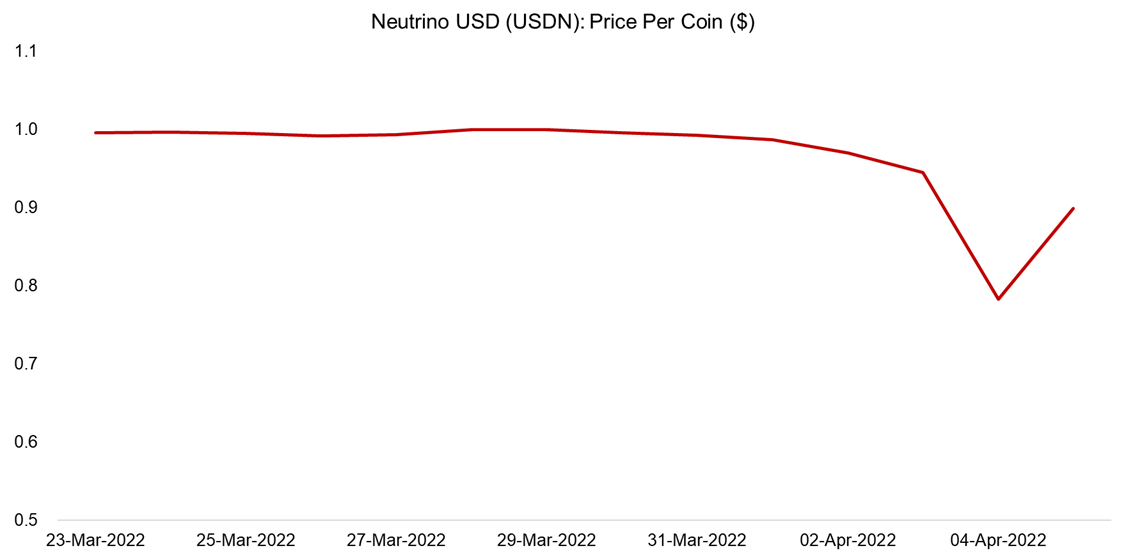

More recently Neutrino USD (USDN), an algorithmic coin that is collateralized by Waves tokens, has failed to provide a stable price. USDN can be minted with and redeemed for Waves token that serves as its main source of demand. Once the price of Waves token tumbled, USDN broke its US Dollar peg and is about 20% off its original price

Source: CoinMarketCap (5th April 2022)

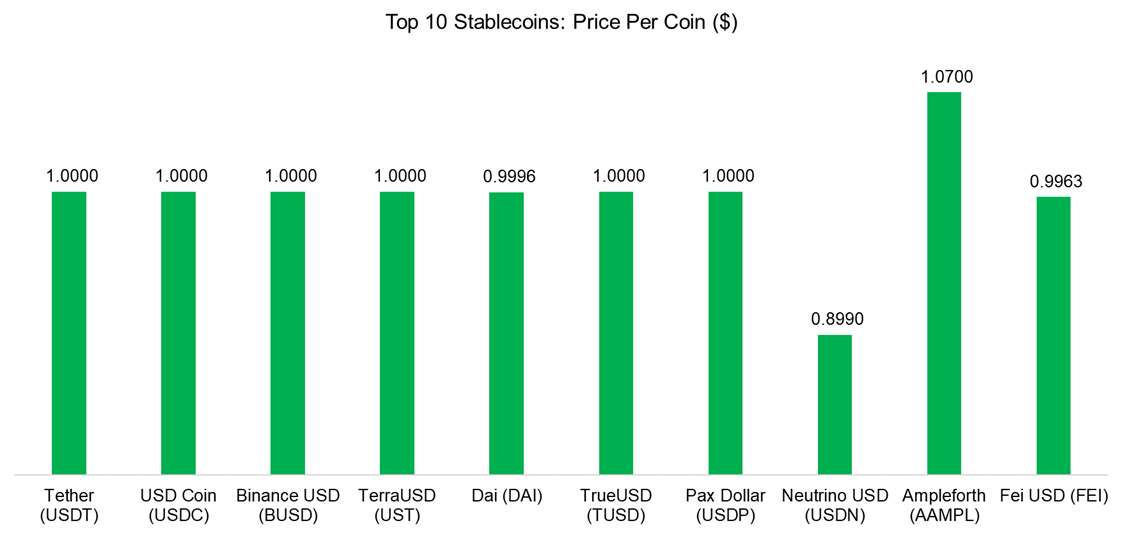

Aside from Neutrino USD, the prices of the other stablecoins of the top 10 by market capitalization have been trading at 1 or close to it.

Source: CoinMarketCap (1st April 2022)

Stablecoins backed by other cryptos face another risk, which is the equivalent of a margin call. Given the volatility of cryptos these stablecoins overcollatorize, but that requires assumptions on the price volatility. If that is larger than expected and a significant downside move occurs, then the stablecoin might not be fully collateralized. Five-sigma moves happen in financial markets more frequently than expected.

Conclusion

The use case for stable coins is obvious: make payments fast and cheap. Naturally, there are many large players like Visa or Western Union that see this as a threat to their business.

However, the real concern is how central banks view stablecoins as it also undermines their powers, which they are unlikely to accept in the medium to long-term. Given this, they are working on central bank digital currency (CDBCs), which potentially makes stablecoins redundant.

Related Research

About the Author

Dilsher Singh Dhingra, is a finance professional working in the investment team of Jackdaw Capital. He has previously worked in private equity with CX Partners focusing on the healthcare, technology, financial services and consumer sector. Prior to this, he worked with Deloitte (India) in the investment banking team across the fmcg, industrials and hospitality sector.