Same, Same, but Different?

February 2022. Reading Time: 10 Minutes. Author: Dilsher Singh Dhingra

Summary

- Coins are a medium of exchange and include both digital and fiat currencies

- All cryptocurrencies coins are tokens, but not all tokens are considered crypto coins

- Platform tokens dominate the token market by market capitalisation

Introduction to Cryptocurrencies

It is difficult to imagine a world without money, although money was not always the paper and plastic money we think of it as of today. Some of our ancestors used shells and other curious items.

Consumers use money to purchase products and services for their daily use, similar to companies that use it for business transaction. Money is what makes the world go round, but it has been subjected to the control of central banks and governments over the last centuries.

Unfortunately, time again and again, these institutions have abused money for their own interests rather than that of their population. Most famously when printing it in an accelerated fashion to finance wars like Germany during Worl War II or unsound economic policies like Zimbabwe in the 2000s.

The arrival of cryptocurrencies is changing the world’s perception of money and financial systems. However, this new world is complex and messy. There are not only cryptocurrencies (crypto coins), but also tokens. These terms are often used interchangeably, but they are not the same.

In this article, we are going to provide a brief overview of the difference between cryptocurrencies and tokens.

What is a Cryptocurrency?

Let’s start with coins, which simply refers to a medium of exchange. Naturally this includes fiat as well as digital money, which means that all cryptocurrencies are coins.

The key characteristic of a cryptocurrency is that they are based on their own blockchain, e.g. Bitcoin on the Bitcoin blockchain and Ethereum on the Ethereum blockchain.

Cryptocurrencies can be used for transactions and therefore are perceived like money, although transacting in them is often quite complicated and anything but like the experience of paying with a credit card in a shop.

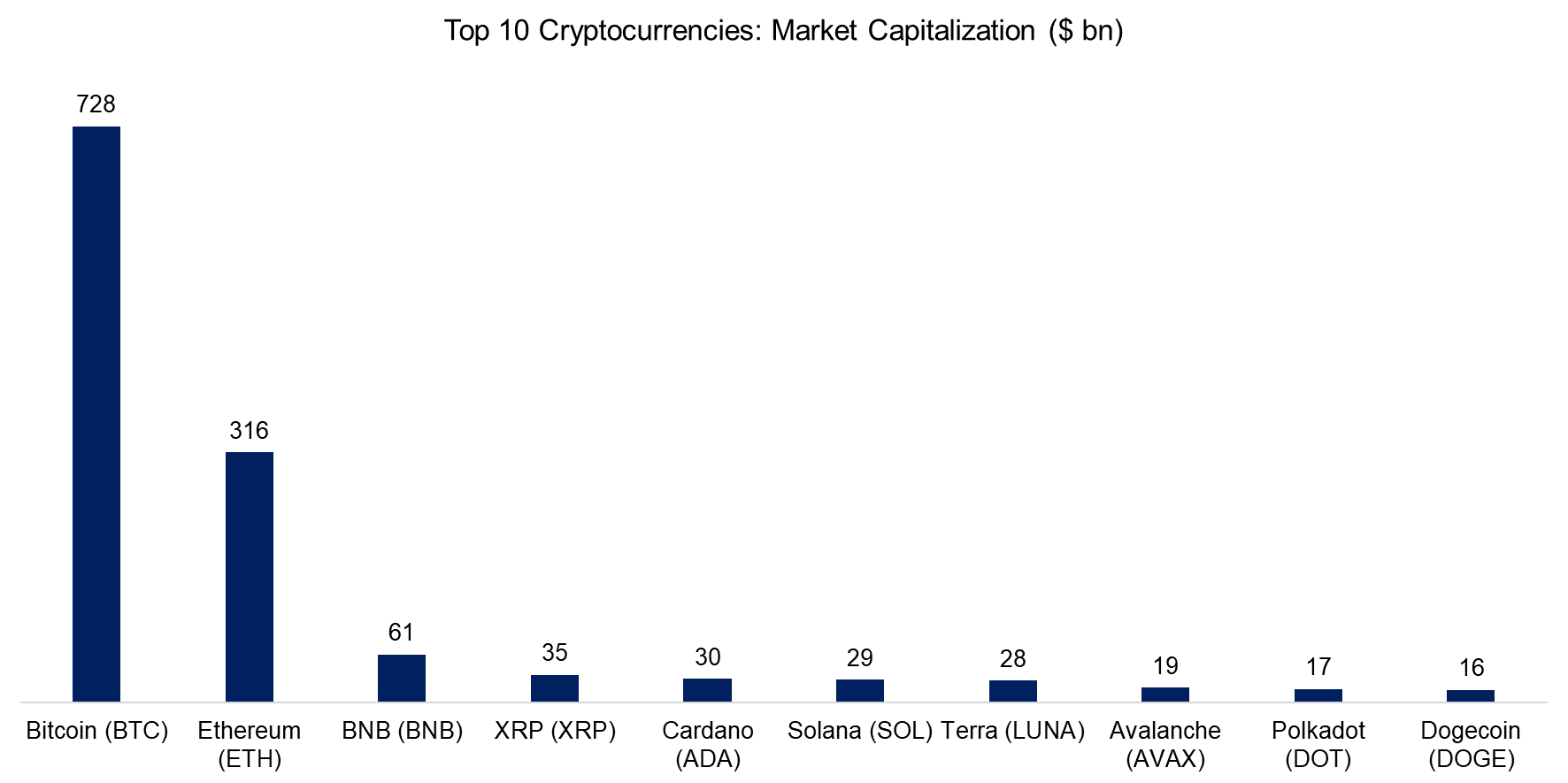

The top 10 cryptocurrencies are as follows:

Source: CoinMarketCap (March 2022)

What is a Token?

Next, let’s define tokens. These are assets that live on blockchains, e.g. most tokens are based on Ethereum and technically are called ERC20 tokens, but they do not have their own blockchains.

Many digital asset projects issue their tokens as a representation of an asset or the utility that it has. They usually give their tokens to their investors during a public sale called ICO (initial coin offering).

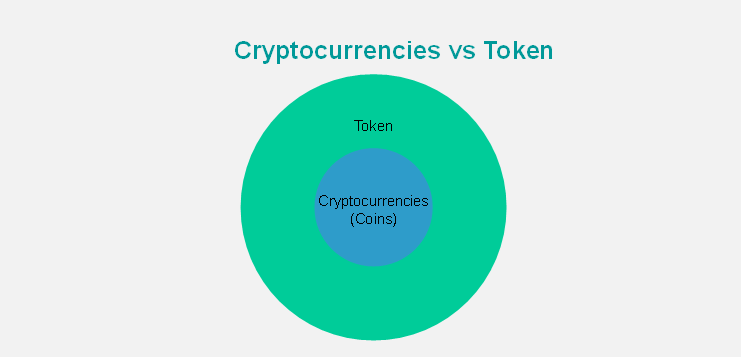

At a fundamental level, both cryptocurrencies and tokens are alike, but they are two different things – all cryptocurrencies are tokens, but not all tokens are considered cryptocurrencies

Source: Jackdaw Capital

Token are meant to have a value, but they cannot be considered as money in the same way cryptocurrencies can be as they are typically exclusively used for payments within the issuer’s ecosystem.

One of the most popular tokens is AXS, which has a market capitalization of $3 billion and is an Ethereum-based token. It is used within Axie Infinity, a blockchain-based game where players can battle, collect, and build a digital kingdom for their game pets. AXS holders can use their token to claim rewards for staking them, playing the game, and participating in key governance votes.

Different Types of Tokens

Tokens have a variety of use cases and go beyond simply representing means of payment. There are five core types of tokens, which are as follows:

Platform Tokens

- Definition: Utilize blockchain to deliver decentralized applications (DApps) for different uses.

- Key platform tokens: Tether, USD Coin, Binance USD

Security Tokens

- Definition: Represents legal ownership of a physical or digital asset. Security tokens are like owning shares in the company itself. Security token holders own something that might pay off through profits or distributions.

- Key security tokens: investors on the Meridio platform can seamlessly trade tokens representing real estate shares and pay in Dai, while Fluidity Factora allows people to invest in a Brooklyn, New York, property by paying with Dai

Transactional Tokens

- Definition: Transactional tokens are used for transactions and live on the sidechain of cryptocurrencies like Bitcoin, allowing for fast, inexpensive transactions by utilizing the immutable nature of the blockchain and the flexibility of smart contracts

- Key transactional tokens: Shiba Inu, FTX Token

Governance Tokens

- Definition: These allow holders to participate in the decision-making for the ecosystem. The evolution of the ecosystem is essentially delegated to its community

- Key governance tokens: Uniswap, Maker

Utility Tokens

- Definition: Integrated into an ecosystem and used to access the services of that ecosystem.

- Key utility tokens: Cronos, Decentraland, The Sandbox, and Axie Infinity

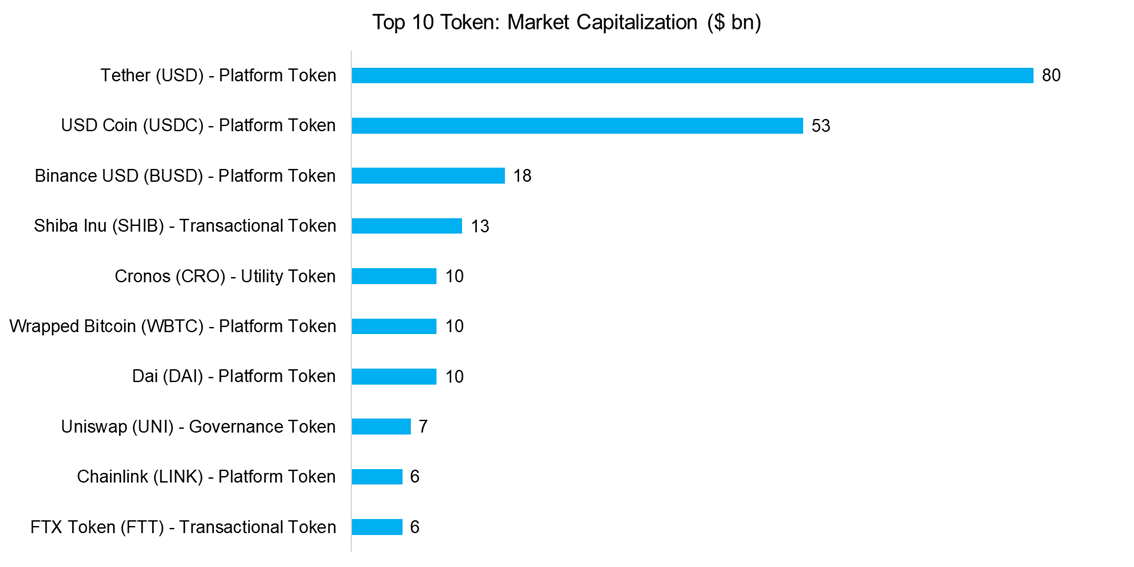

The 10 largest tokens are dominated by platform tokens. The largest transactional token only surfaces at the fourth spot (SHIB with a market capitalisation of $13 billion) and the largest utility token at the fifth space (CRO with a market capitalisation of $10 billion).

Source: CoinMarketCap (February 2022)

Further Thoughts

If look at the league table of the top 10 companies by market capitalization in 1990, then this was dominated by financial institutions like banks and insurance companies. In 2020, it was dominated by technology companies.

The cryptocurrency space evolves much quicker than the non-digital economy and we will likely see similar dramatic changes with regards to the league tables for cryptocurrencies and token as of today.

Given this, it might be worth considering to get exposure via an indexing strategy rather than cherry-picking cryptocurrencies and token.

About the Author

Dilsher Singh Dhingra, is a finance professional working in the investment team of Jackdaw Capital. He has previously worked in private equity with CX Partners focusing on the healthcare, technology, financial services and consumer sector. Prior to this, he worked with Deloitte (India) in the investment banking team across the fmcg, industrials and hospitality sector.