Making money in the crypto bear market

May 2022. Reading Time: 8 Minutes. Author: Dilsher Singh Dhingra

Introduction

In a recent research article, Risk of Cryptocurrency Investment in 5 Charts, we highlighted that more than 85% of tokens and coins are trading below their first listing price, which implies it is difficult to make money with cryptocurrencies on average.

As well-established coins like Bitcoin and Ethereum sold off recently and others like Luna collapses, the interest in shorting cryptocurrencies had increased. Although some cryptocurrencies investors are evangelists, most are there for the money, which can be made by going long or short.

We are going to provide a brief overview of how to short cryptocurrencies.

Futures Market

CBOE was the first regulated exchange to launch cryptocurrency futures based of Bitcoin in December 2017, but liquidated these shortly thereafter. The CME launched their futures in the same month and has continued offering these to institutional investors, and also added Ethereum futures.

Unregulated exchanges like Binance or ByBit also offer futures to their clients and with significantly more leverage. At CME a margin of 50% is required to trade Bitcoin futures, compared to less than 10% at Binance.

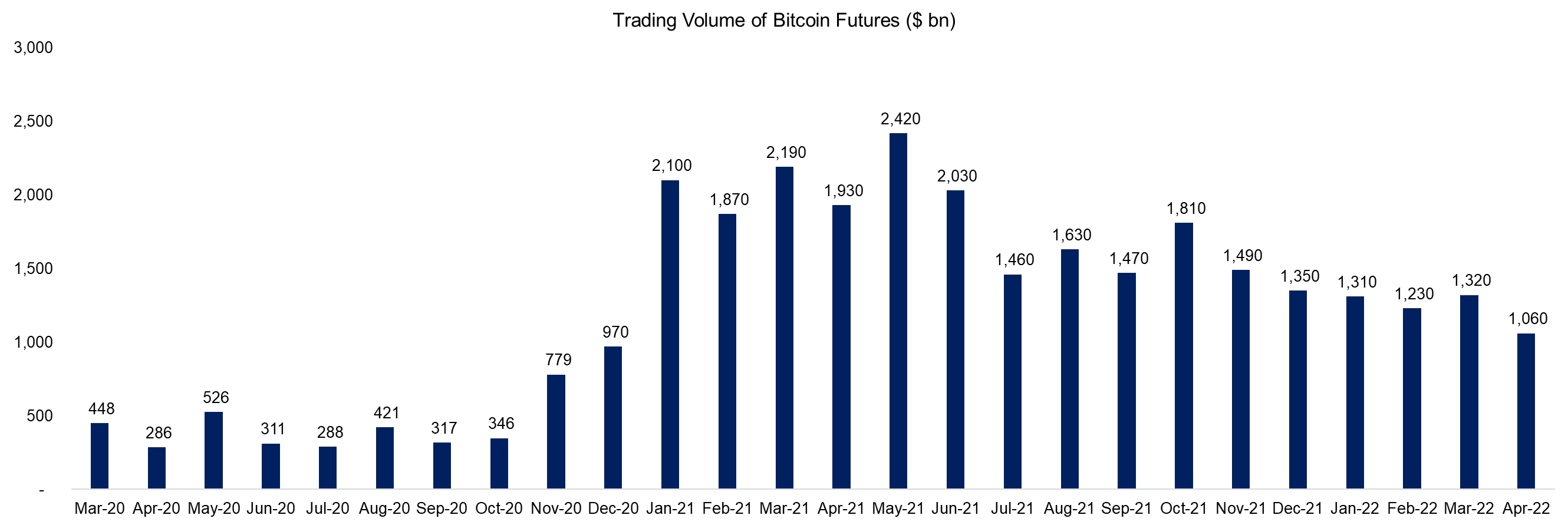

However, although cryptocurrencies continue to get more attention in the media on a daily basis, the amount of Bitcoin futures traded has decreased in volume. We observe that the volume increased by 5 times from March 2020 to April 2021, which coincides with Bitcoin peaking at $63,000. The volume decreased and only slightly recovered in October 2021, where Bitcoin hit its all-time high price of $68,000.

Although the volume will decrease as the price declines, the magnitude is somewhat perplexing as investing into Bitcoin has become so much easier with hundreds of crypto investing apps having launched in the last 12 months. It seems futures are not particular relevant for Bitcoin investors.

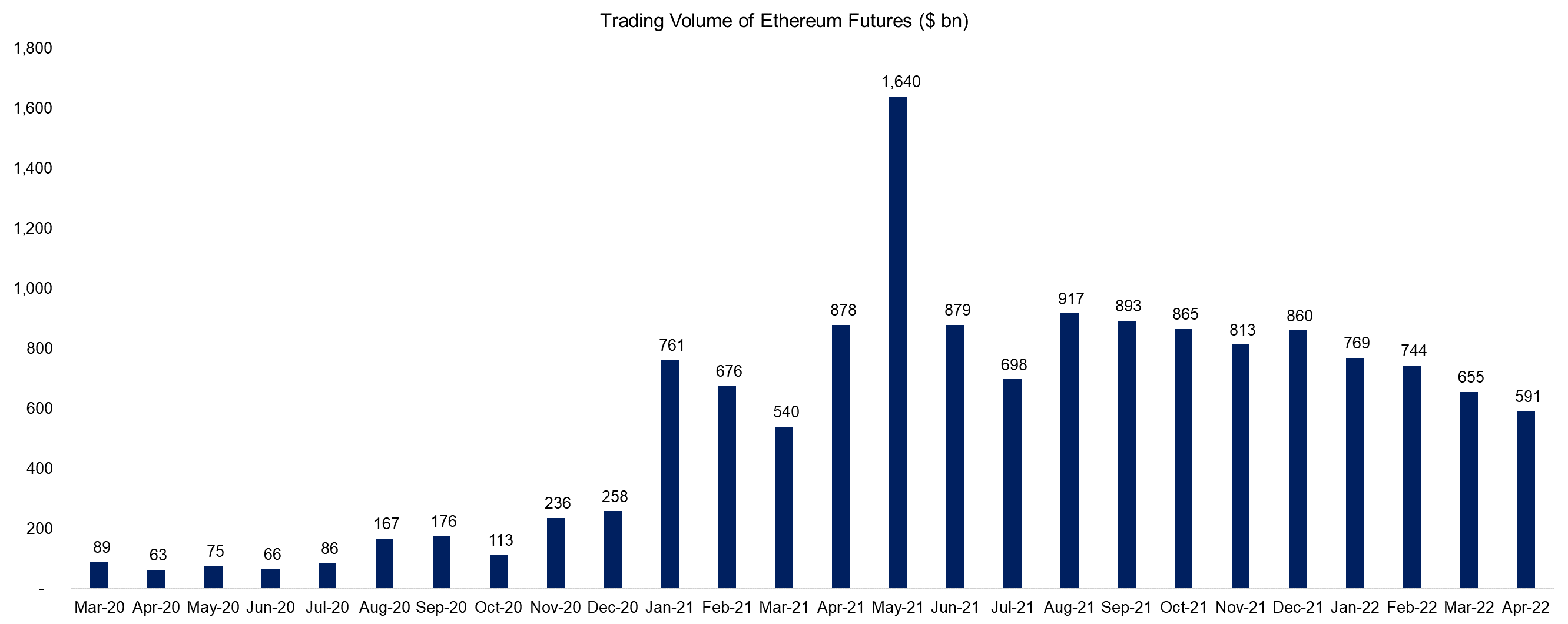

Investors might assume that this is unique to Bitcoin futures, but the trend in Ethereum futures was almost identical.

Ethereum hit its all-time high price of approximately $3,900 in May 2021, post which the volume dropped by 50%. Though volume has been dropping ever since, but it has been at a much slower pace when compared with Bitcoin.

Binary Options Trading

In addition to shorting via futures, investors can also use options to implement a negative perspective on cryptos. The key advantage to using option is that the downside risk is limited to the premium paid for the put, but the upside is significant. Naturally cryptos can only fall to 0, so there is a limit to the upside as well, but options, as per their name, provide optionality.

However, it is worth highlighting that the volatility of the underlying security, i.e the cryptocurrency, is a major driver of the performance of the option. Cryptos exhibit high volatility and there might be the case the cryptos fall in value, but the put holder generates no return if volatility falls as well. Popular venues for trading options are Deribit, CME and OKEx.

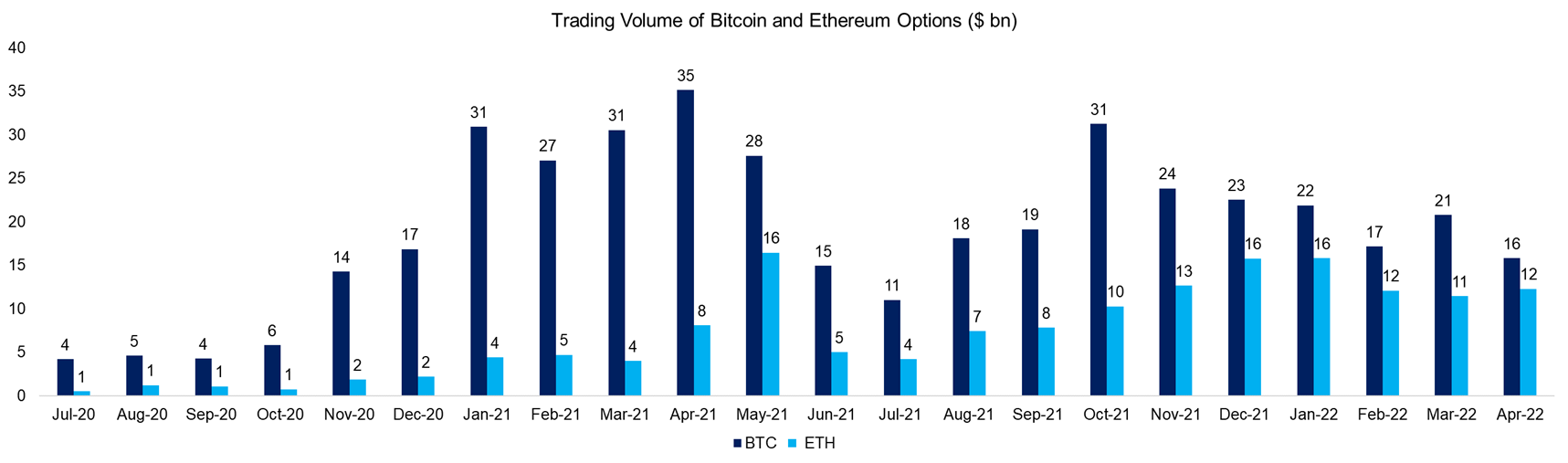

Comparing the trading volume of Bitcoin and Ethereum options shows roughly the same trends as in the futures markets, i.e the volume follows the price.

Prediction Markets

Prediction markets are another way to consider shorting cryptocurrencies. Prediction markets in crypto are similar to those in mainstream markets. Investors can create an event to make a wager based on the outcome, eg a decline of 50% in Bitcoin. Popular crypto prediction markets are Augur, Gnosis’ Omen, and Polymarket.

Shorting via Exchanges or Brokers

The simplest way to short cryptos is via large brokers and exchanges like Binance, Kraken, FTX, eToro and Phemex. They offer investors to go long and short cryptocurrencies. This requires a margin account where investors post collateral, typically cash. Some of the coins available to long and short are Bitcoin, Ethereum, Litecoin, Cardano, Solana, Polygon, Uniswap, Axie Infinity to name a few.

Crypto trading brokers like Exness, AvaTrade, BDSwiss, Eightcap, OctaFX also offer crypto CFDs (contract for differences) for a number of cryptocurrencies. Again, like margin trading, using CFDs to trade cryptocurrencies offers the flexibility of taking a position on whether Bitcoin rises or falls without having to actually own any Bitcoin. The main cost when trading a cryptocurrency CFD is the spread (difference between the price and the offer to purchase/sell).

Exchange Traded Funds

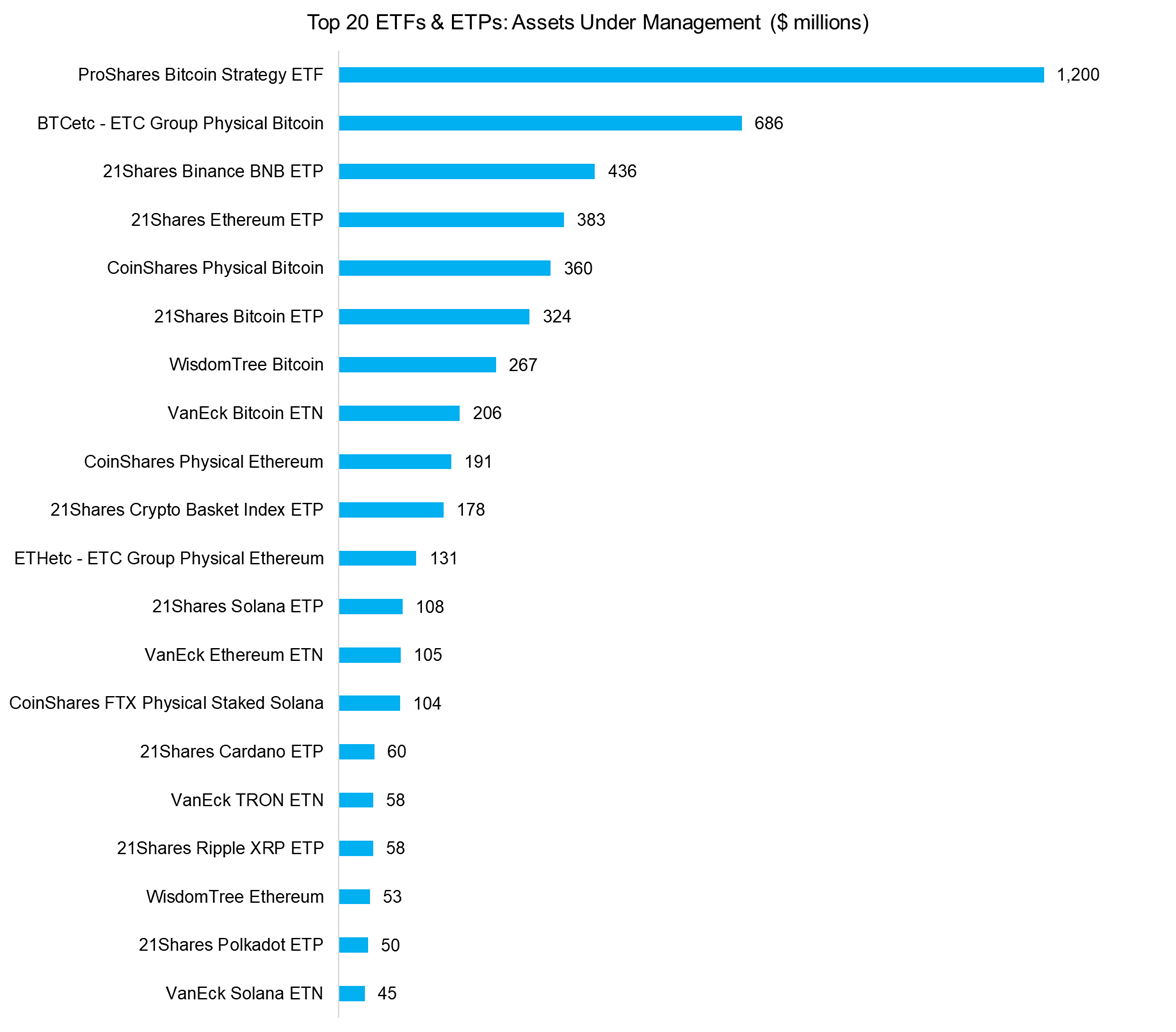

Finally, investors can also short cryptos by shorting ETFs that provide exposure to these, mostly via futures. The total AUM of the top 20 crypto ETFs is $5 billion and are only available for the largest cryptos like Bitcoin, Ethereum, Solana, XRP Ripple, or Cardano.

Source: JustETF.com and Jackdaw Capital

In addition to shorting ETFs that provide exposure to cryptocurrencies, investors can also buy short ETFs, eg via the BetaPro Bitcoin Inverse ETF (BITI.TO) or 21Shares Short Bitcoin ETP

Shorting NFTs

The NFT market is likely in a worse position than cryptocurrencies as even fewer NFTs appreciate. The majority becomes worthless, which makes it an interesting space from a shorting perspective.

However, there are few established venues that offer to short NFTs. Some that are being developed are Mimicry, which creates a token that follows the market capitalization of an NFT collection. Investors can go long or short this token.

NFTures is similar to Mimicry in that it allows users to go long or short a token related to NFTs, although this may be a single item or collection

Further Thoughts

Cryptocurrencies experienced a severe market crash in 2018 and many declined by more than 80%. Post this crypto winter came the next boom that takes us to the present, where it is unclear whether we are experiencing a crash, or are entering another bear pro-longed market.

Either way, it is beneficial that investors have more instruments at their disposal to benefit from the up and downs of markets. In this way, cryptocurrencies are no different from traditional asset classes.

Related Research

About the Author

Dilsher Singh Dhingra, is a finance professional working in the investment team of Jackdaw Capital. He has previously worked in private equity with CX Partners focusing on the healthcare, technology, financial services and consumer sector. Prior to this, he worked with Deloitte (India) in the investment banking team across the fmcg, industrials and hospitality sector.