The probability of a profitable cryptocurrency investment is less than 15%

April 2022. Reading Time: 10 Minutes. Author: Kaushik Ganesan.

Introduction

In March 2022, 616 tokens and 47 coins were launched, which brings the total number of cryptocurrencies close to 10,000. As a comparison, there are only about 3,000 tradable stocks in the US, although that number increases significantly when illiquid stocks traded over the counter are included. However, given that the US stock market is more than 100 years old, it is interesting that the cryptocurrency space has eclipsed equities despite being less than 10 years old.

Although cryptocurrencies are unregulated, financial crime is prosecuted with regulated products. Last month two 20-year-old non-fungible token (NFT) creators were arrested for stealing $1.1 million from investors. They have been charged on accounts of money laundering and fraud, which carries a 20-year sentence in the US.

Investing in tokens, coins, NFTs, etc., has never been easier, but the number of frauds, hacks and similar malicious activities have increased accordingly. Given that the cryptocurrency space is unregulated, technologically complex, and awash with inexperienced investors, making it a perfect place for bad actors.

In this article, we will explore the risks of investing in cryptocurrencies.

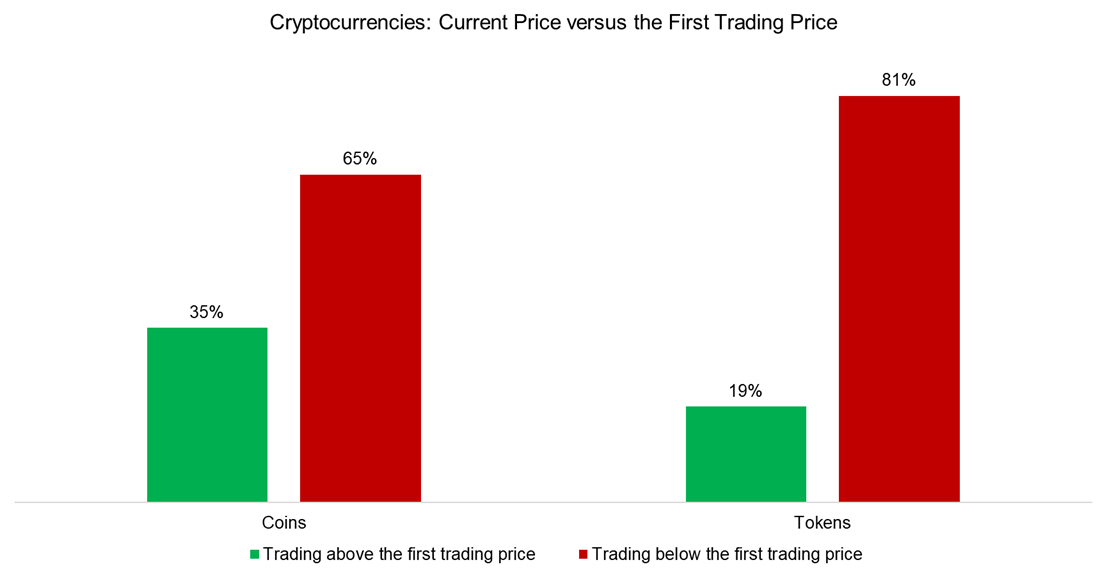

Cryptocurrencies Trading Above or Below the First Trading Price

First, we take the entire universe of cryptocurrencies that have been trading since 2013, which includes 10,000 cryptocurrencies as of April 2022. We distinguish between tokens and coins, then calculate how many of these are trading above and below their first trading price. We observe that investors have lost money on 80% of the tokens and 65% on coin investments, which highlights the risks of cryptocurrencies.

Source: Jackdaw Capital, CoinMarketCap (April 2022)

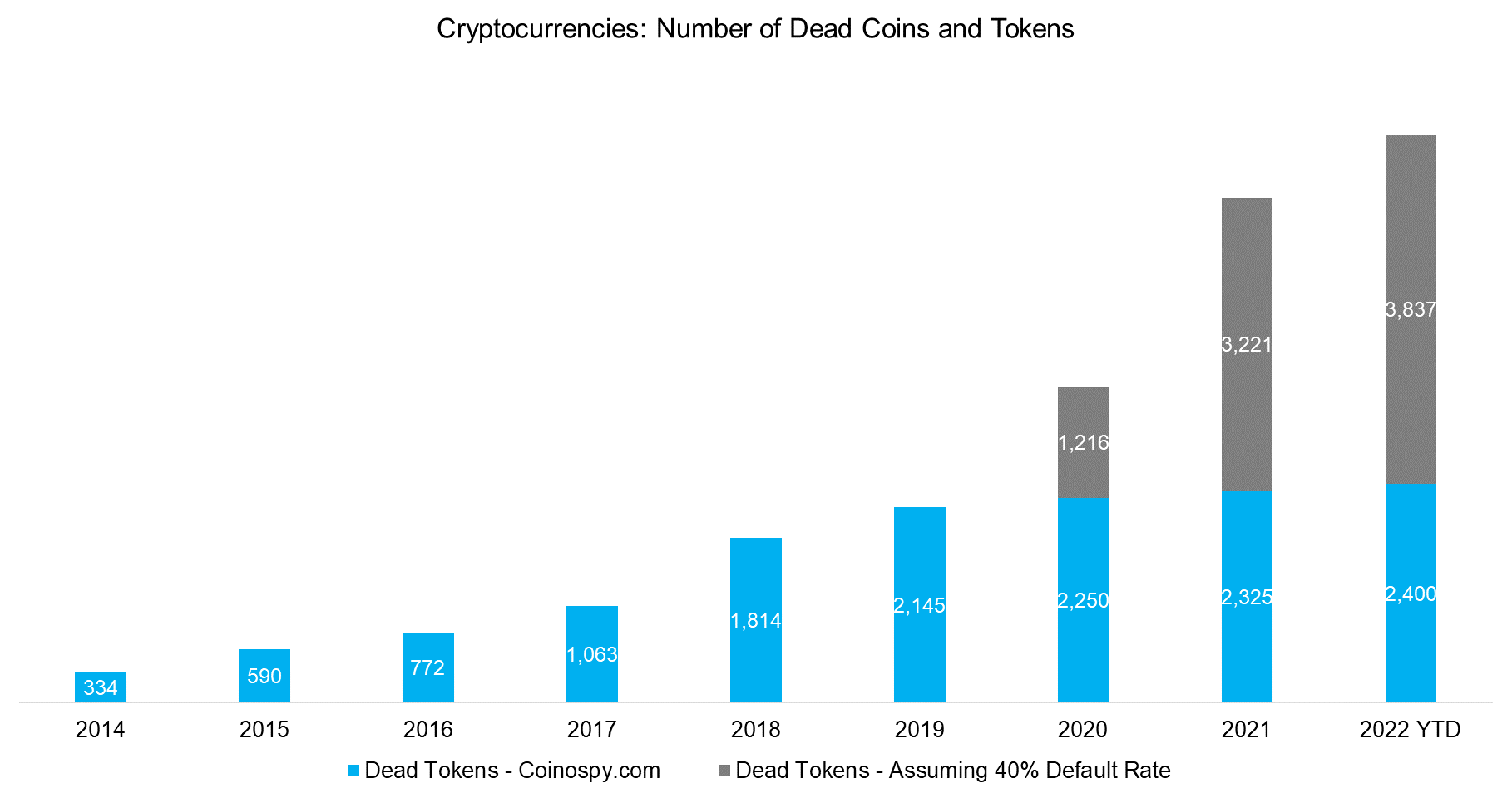

The Rise of Dead Cryptocurrencies

Our analysis only includes cryptocurrencies that are still trading and ignores ones that have died, i.e. our data is subject to survivorship bias. Coinospy provides data on tokens and coins that have died due to various reasons. As of April 2022, there were approximately 2,400 failed projects.

Somewhat unusual, the number of dead projects has hardly increased between 2019 and 2022, despite several thousand new cryptocurrencies having launched, which is unlikely. Token launches, like the IPOs of public companies, fail all the time. We believe there is a data or reporting issue and assume a 40% default rate, which is in line with previous years. This would increase the number of dead projects to more than 6,000.

Source: Jackdaw Capital, Coinospy, CoinMarketCap (April 2022)

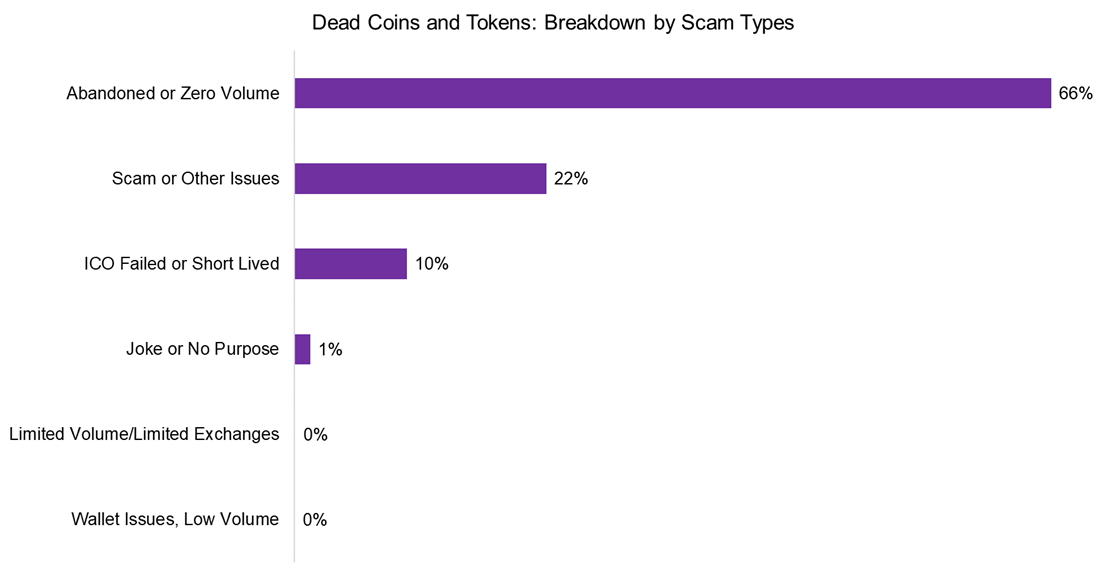

Breakdown by Scam Types

Coinospy provides various reasons why cryptocurrency projects fail. The key reason is that the developers fail to execute an initial offering or simply abandon the project, which raises the question of what happens with any capital that was raised in earlier private rounds. A recent example is the Squid Game token (symbol: SQUID), where the SQUID developers abandoned the project once it hit a price of $2,861, profiting over $2 million.

The second key reason for projects to fail is that they are simple scams, which can take various forms. Projects like OneCoin, PlusToken, BitConnect, etc relied on gullible investors hoping to make quick money. These projects used money from new investors to pay returns to existing holders – much like Bernie Medoff’s Ponzi scheme.

Source: Jackdaw Capital, Coinospy

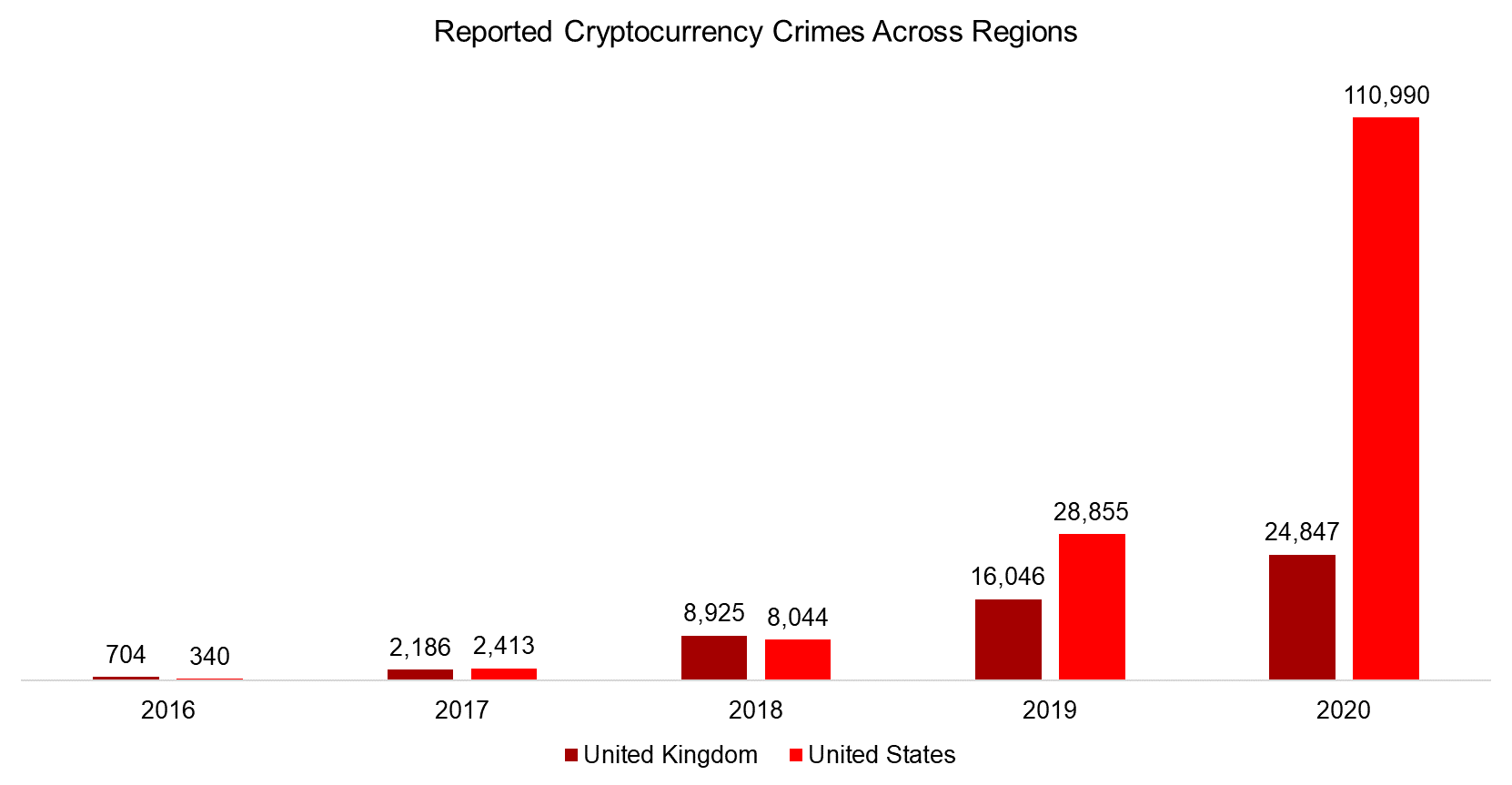

Reported Cryptocurrency Crimes

Although the cryptocurrency space is largely unregulated, investors still file cases when they believe illegal activities have occurred. Given that the number of tokens and coins has increased rapidly in the last few years, so has the number of reported crimes.

In the US, there were more than 100,000 reported crimes related to cryptocurrencies in 2020, compared to about 25,000 in the UK. However, the true number of crimes is likely to be much higher as most investors do not report crimes, simply because most of their cryptocurrency holdings have not been declared to tax authorities, which creates a reluctance to report crimes.

Source: Jackdaw Capital, Crypto Head

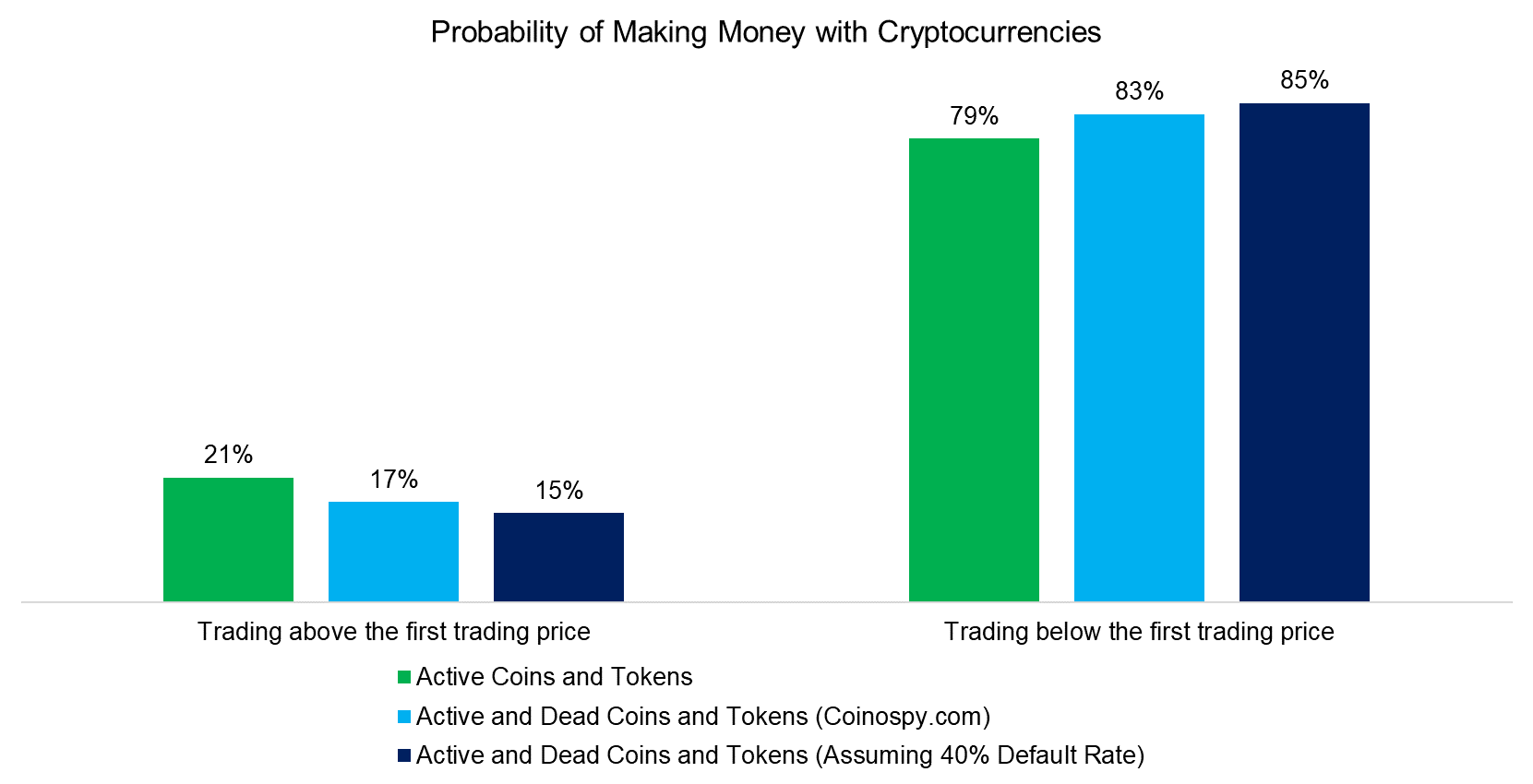

Probability of Winning in the Cryptocurrency Market

The large number of failed projects implies that the likelihood of picking a profitable cryptocurrency investment is likely less than 20%. We take the universe of tokens and coins still trading today, and adjust that for the number of dead cryptocurrencies, once using the original and adjusted data from Coinospy. Essentially, we correct the dataset for the survivorship bias.

This analysis shows that only 15% of the tokens and coins end up being profitable from the day of their initial offering. Stated differently, the odds of making money in the cryptocurrency space are less than winning in Blackjack (42%).

Source: Jackdaw Capital, Coinospy, CoinMarketCap (April 2022)

Further Thoughts

Between 2011 and 2021 almost $20 billion worth of crypto offenses have been committed. The most notable scams are OneCoin ($4 billion), PlusToken ($3 billion), and BitConnect ($3 billion). Last year the Federal Trade Commission (FTC) warned that cryptocurrency fraud and scams are on the rise as more investors see the cryptocurrency space as a get-rich-quick scheme. Although the magnitude of the crimes are staggering, many crypto investors have become more careful and authorities are also becoming better at uncovering illegal activities. The nature of the blockchain, where transactions can be traced given public ledgers, facilitates detective work.

Furthermore, the probability of finding a winning investment only decreased from 20% to 15% when including failed projects, whereof many are scams.

The majority of losses are simply from cryptocurrencies decreasing in value, which raises the question of what is driving prices. Theoretically, it is their utilization as they represent currencies, but this relationship is difficult to quantify. Given all this, most investors are better off accepting the evidence from trading stocks, i.e. stock picking is a fools’ game, and are better served by simply buying an index. Although there are only a few indices in the cryptocurrency space, it likely represents the best way to capture exposure to blockchain for self-directed investors.

About the Author

Kaushik Ramnath Ganesan is a Technology Investment Analyst at Jackdaw Capital. He comes from a computer science background and completed the CQF (Certificate in Quantitative Finance) program. At Jackdaw Capital he applies computer science, finance, and mathematics to bring blockchain technology mainstream.