Short now, pay later?

May 2022. Reading Time: 10 Minutes. Author: Sidharth Sachdeva

Introduction

Buy Now Pay Later or BNPL, as it is popularly known, is a financing option which allows consumers to buy a product or avail a service without having to worry about paying for it immediately.

It’s simply a short-term loan product where the BNPL lender pays the merchant or service provider at the point-of-sale and allows consumers to repay the loan at a future date with little or no interest charges. The repayment can either be in lump sum or in the form of equated monthly instalments (EMIs). BNPL providers cover their costs by charging commission fees to shops or by applying late payment fees to consumers. BNPL is offered across the globe by many banks and Fintech firms and has gained significant traction in the past few years.

BNPL companies make money from two types of clients:

- Merchants usually pay a charge ranging from 2 to 8 percent of the purchase amount. Some providers also charge a flat fee of 30 cents per transaction

- Customers sometimes are charged interest on the instalments and late fees when payments are delayed

The onset of COVID-19 pandemic had provided a huge impetus to e-commerce industry and BNPL was a direct beneficiary of this trend. The BNPL industry has modernized layaway and instalment payments to offer consumers flexible payment options for their purchases. Compared to credit cards, intended to be used repeatedly, BNPL solutions are applied to individual transactions—appealing to consumers who want to make less of a financial commitment, even on lower ticket items.

The BNPL Players

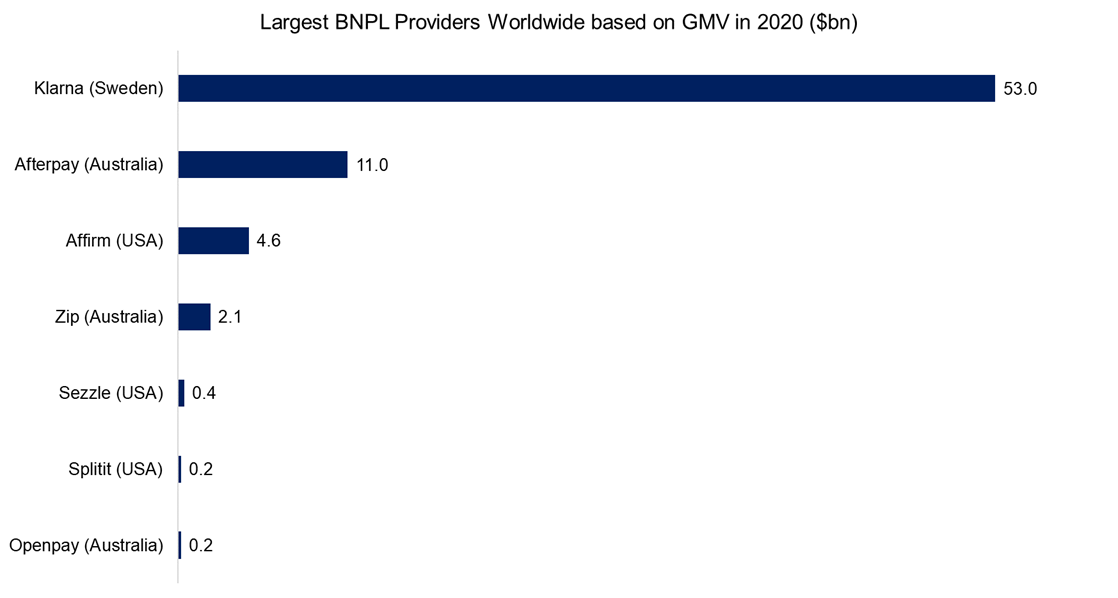

Here is a look at the leading BNPL companies as measured by the gross merchandise value (GMV) generated in 2020. The private Swedish company Klarna is the clear market leader and was valued at $45.6bn when it raised capital in February 2022.

Source: https://www.statista.com

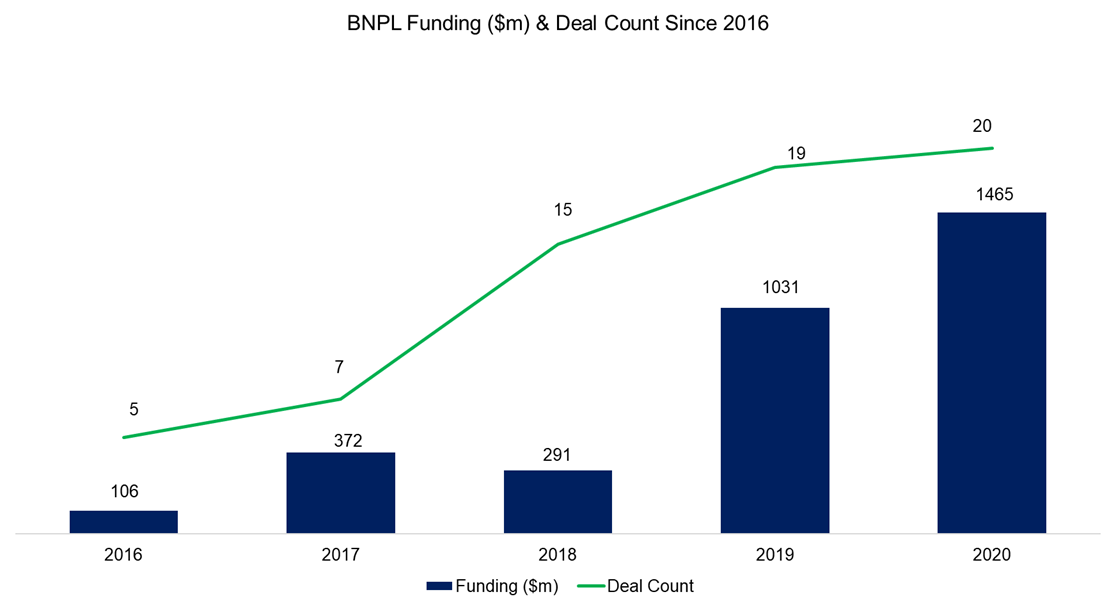

We can also observe the venture capital firms have allocated steadily increasing amounts of capital to the space.

Source: https://www.cbinsights.com/research/

Recent Challenges of the BNPL Industry

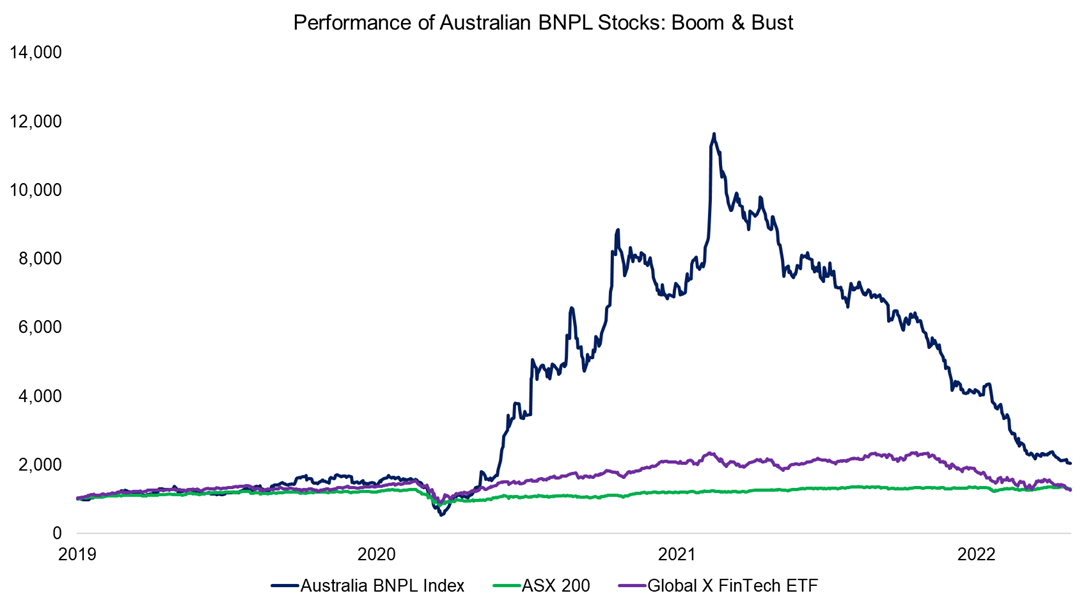

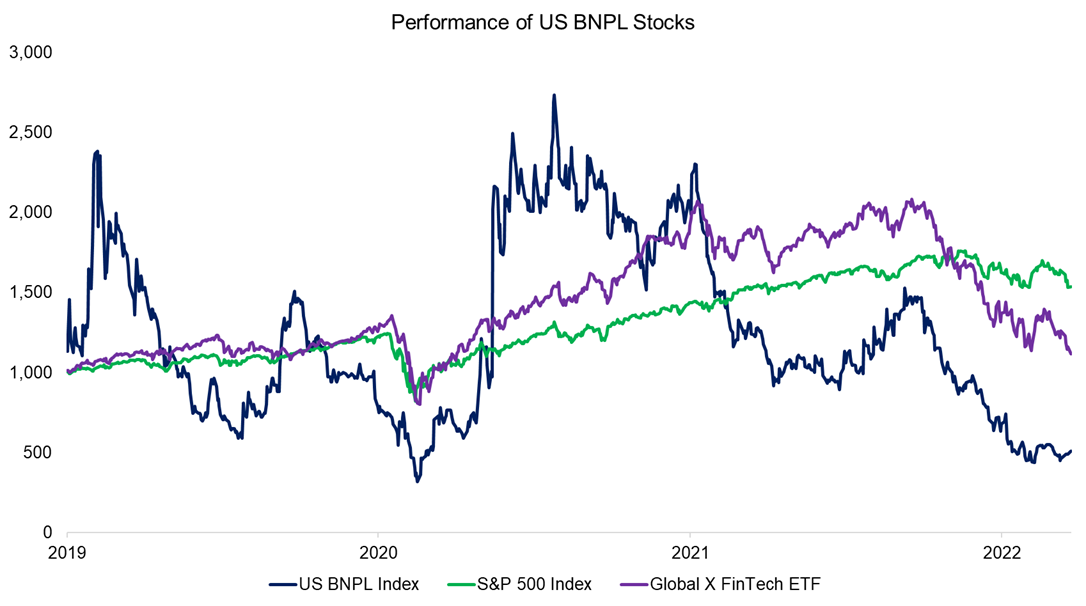

In 2020, BNPL became a hot topic in fintech and funding poured into the sector, but there was a sharp reversal of this investor enthusiasm in 2021. Although many of the large BNPL companies are private, there are ten listed in Australia and two in the US.

We create equal weighted BNPL indices for both regions and benchmark the performance of these to the regional stock markets as well as a global fintech index. We observe a boom and bust of listed BNPL companies in Australia and a highly volatile performance in the US.

Source: Yahoo Finance (data range from 2019/01/01 to 2022/04/27 for Australia Index & 2019/02/01 to 2022/04/27 for US Index)

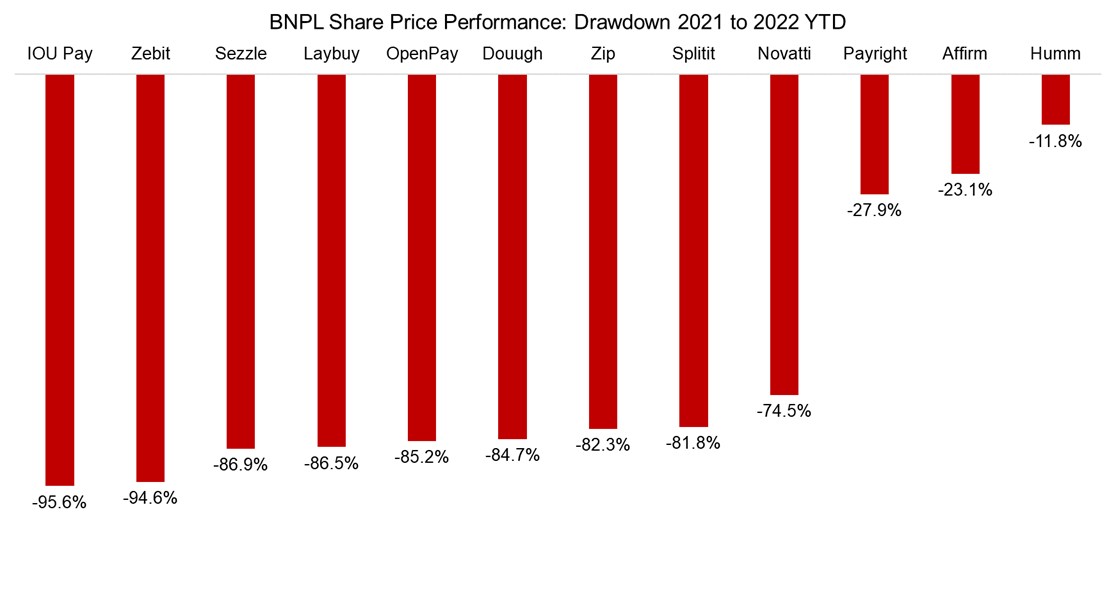

If we calculate the maximum drawdown from 2021 till 2022 YTD, then the BNPL companies fell by ~70% on average, which indicates a proper crash of these stocks.

Source: Yahoo Finance

What is ailing BNPL?

The space which appeared so promising few years back has underperformed the stock market by a wide margin in 2022. Many investors are now concerned about the sustainability of the BNPL business industry for a variety of reasons:

- Increased competition:

The significant influx of competition led to higher customer acquisition costs. In essence, the product became a commodity where existing players compete on interest rates offered to consumers. None of the large players offering BNPL are profitable due to high customer acquisition and marketing costs. One article by Finextra Research authored by Pablo López Gil-Albarellos flags the concern on the sustainability of BNPL business model by modelling this as follows:

- A $100 sale earns (on average) $4 in merchant revenue with 56 cents in late fees = $4.56.

- Expenses are $4.75 – of which $1.00 are credit losses, 16 cents funding, 34 cents share purchases and $3.25 in marketing, operations and salaries.

- As a result, unit economics are negative

Furthermore, as the market grew for BNPL companies, large companies like Paypal, Mastercard, Visa and Apple have entered the market. Due to their size and experience, these companies have better underwriting mechanisms and risk management practices.

- Increased regulation:

The BNPL industry was considered lightly regulated as the inherent interest free payments ensured the players remained isolated from the traditional lending lens of the regulators. But off late, regulators have stepped up vigil on the activities of BNPL companies.

- UK: The U.K. government, meanwhile, is also planning to introduce BNPL regulations, putting the companies under the auspices of the Financial Conduct Authority, which regulates financial services firms.

- USA: The Consumer Financial Protection Bureau asked several high-profile BNPL firms – Affirm, Afterpay, Klarna, PayPal and Zip – for details on their product and practices, amid concerns that the financing products is putting consumers at risk in December 2021.

- European Union: The EU is tightening its rules on consumer credit to provide more protection for consumers. In June 2021, the European Commission presented a new proposal to regulate consumer credit, bringing BNPL products under the scope of the regulation.

- Australia: The central bank adopted a decision in October 2021 ordering BNPL firms to remove their no-surcharge rules. This meant that merchants are permitted to apply a surcharge to customers for using this method of payment if they wish to offset fees paid to the BNPL providers. On December 2021, Treasurer Josh Frydenberg delivered a speech proposing a major overhaul of the Australian payments system, including new regulation for BNPL products. The new proposals, which may include changes in the current legislation, are expected by mid-2022.

- Changing Macro Environment:

Before pandemic the environment of low or negative central bank interest rates, controllable inflation and moderate level of consumer spending provided the ideal platform for BNPL companies to flourish. The Covid-19 pandemic provided the impetus to E-commerce and BNPL companies to leverage the opportunity. With global inflation rising and central banks across the globe putting brakes on Quantitative Easing, the macro environment is completely changed for BNPL companies. Traditional lenders will enjoy higher margins and higher product volumes. At the same time, they will leverage their core business capabilities – efficient risk management and effective collection processes. On the contrary BNPL will face the challenge of increasing cost of financing and a spike in delinquencies among customers is already visible in many cases.

Further Thoughts

Stock market investors have clearly lost their love for BNPL companies, which will eventually permeate to private markets as well. Given this, we can expect a consolidation amongst BNPL players as well as the acquisition of these by the larger financial services companies.

Although some of these companies have reached multi-billion valuations, they are still young companies that have not gone through a complete credit cycle. Lower economic growth will expose the flaws of providing credit to the unworthy, similar to the subprime crisis, and create further pain for investors. Given this, short now, pay later might be more appropriate.

About the Author