July 2022. Reading Time: 10 Minutes. Author: Sidharth Sachdeva

Introduction to NFTs

From the ownership of physical assets and art work back in old times, today digitalization has opened new avenues for ownership of multiple assets. Digital ownership has brought with it tokenization, enabling brands and creators to offer exclusive & curated services to their communities. A decade ago, who would have thought of having weddings in Metaverse. The pace at which technology is impacting our lives is unprecedented and no one today can predict how our lives will evolve 10 years from now.

While the modern art world is naturally one of upheaval, the meteoric rise of Non-Fungible Tokens or NFTs in the past pandemic year has left many wondering how new digital art is shaping the artistic landscape. While the concept of NFTs has been around since 2014, they were mostly under the radar until last year, when they suddenly commanded headlines around the world. An NFT is a special type of digital asset or token that is unique and not interchangeable with another digital asset token (i.e., fungible, thus it is referred to as a “non-fungible token” (NFT).

NFT Market by Numbers

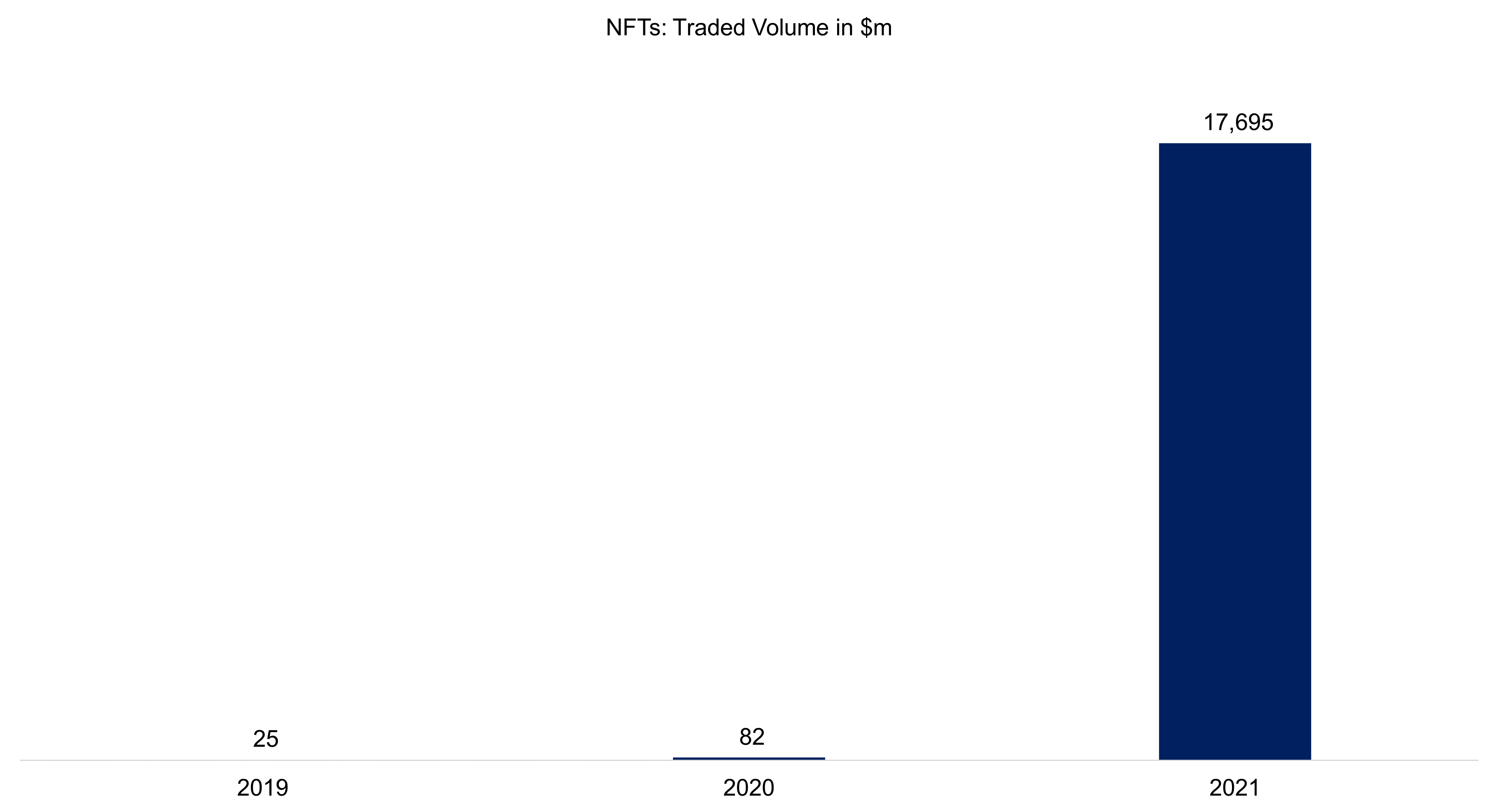

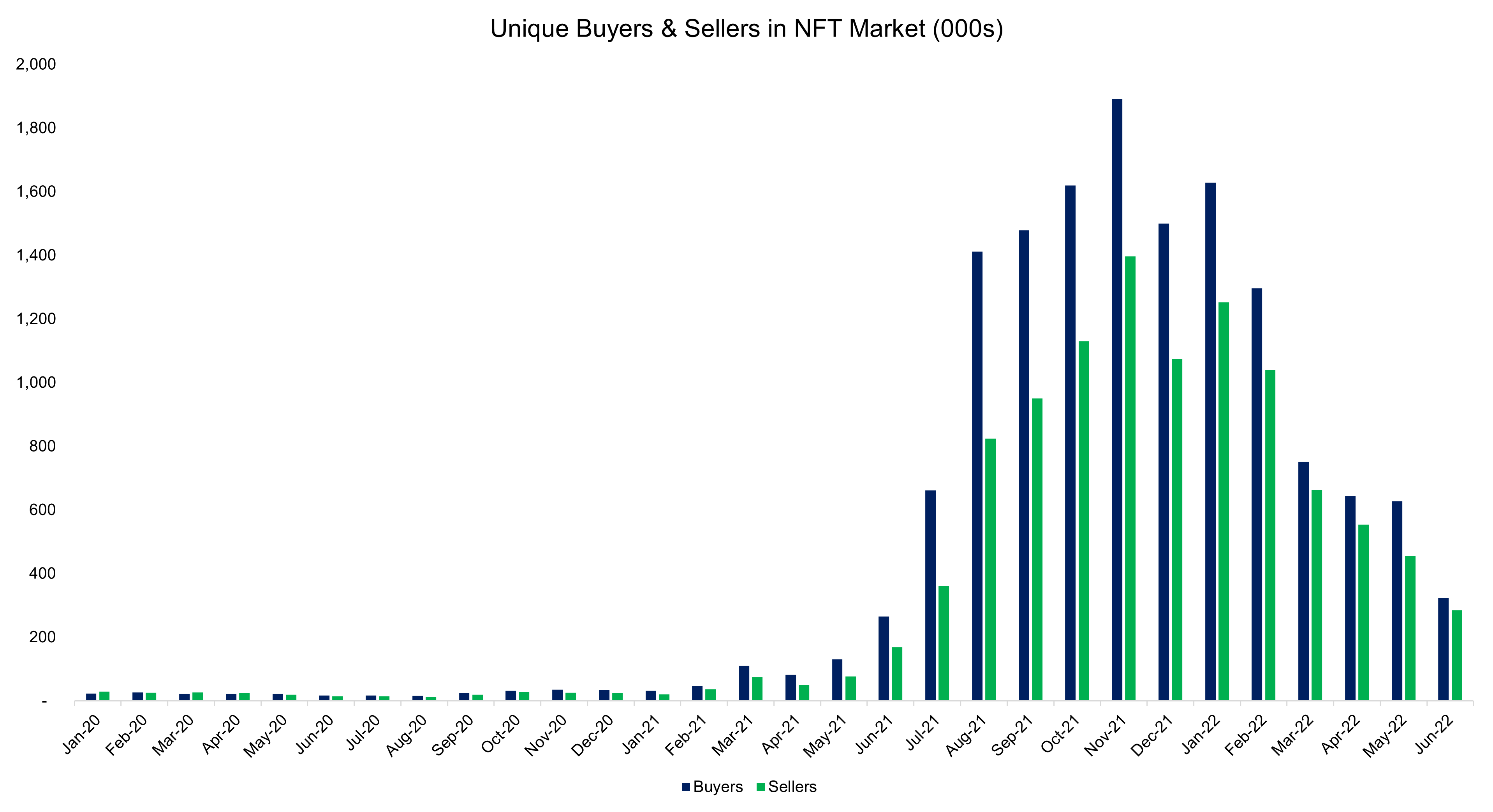

Though NFTs have been around for some time, the real impetus came in 2021.

Source: Yearly NFT Market Report 2021 by NonFungible

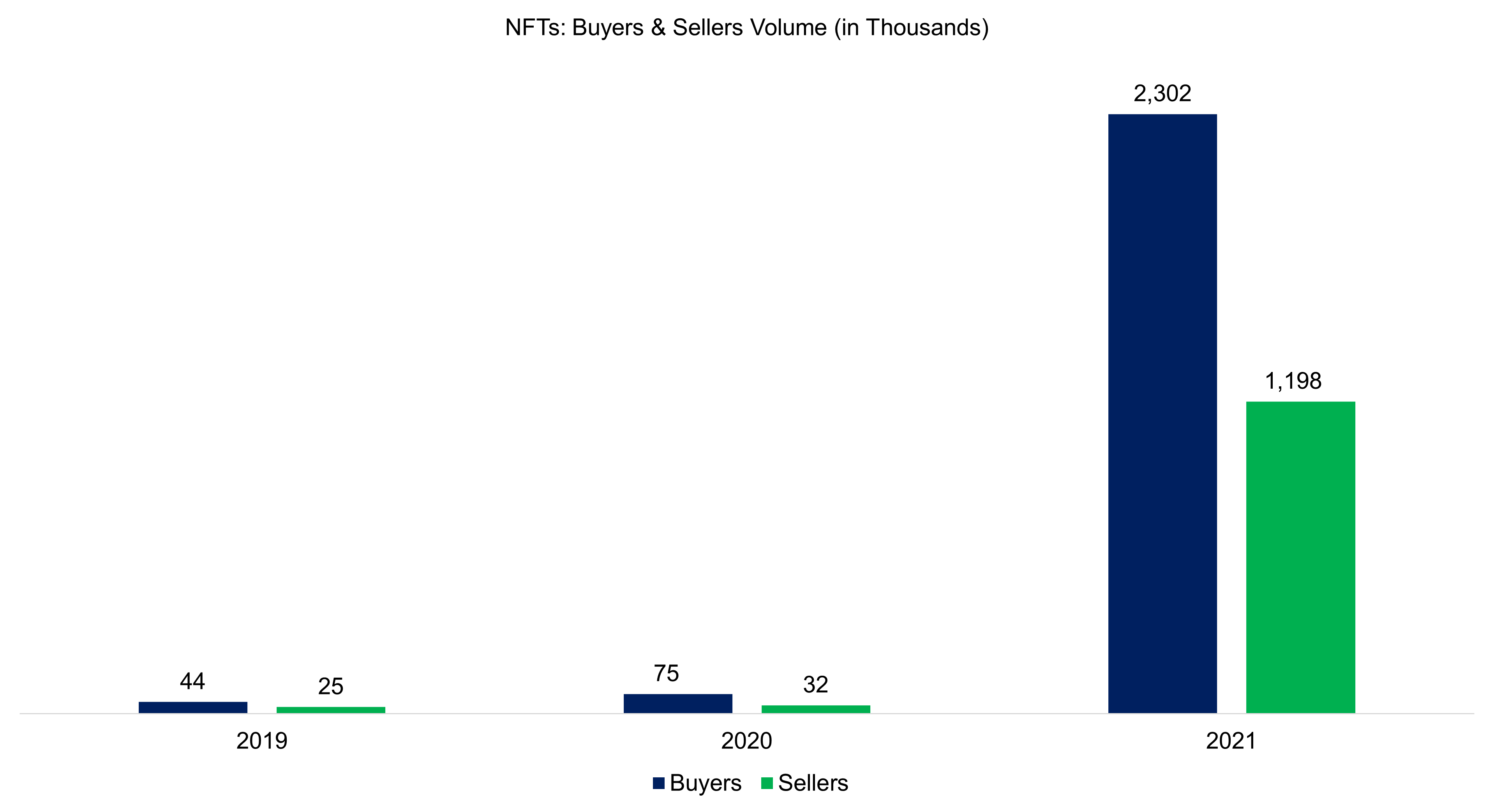

The same is evident from the number of buyers and sellers in the NFT market. While there were tailwinds for cryptocurrency markets and NFTs on account of the Covid-19 pandemic. Many people believed that the NFT has value independently of market conditions as most successful projects have seen price appreciation with minimal correlation to cryptocurrency prices.

Source: Yearly NFT Market Report 2021 by NonFungible

NFT Sales by Category

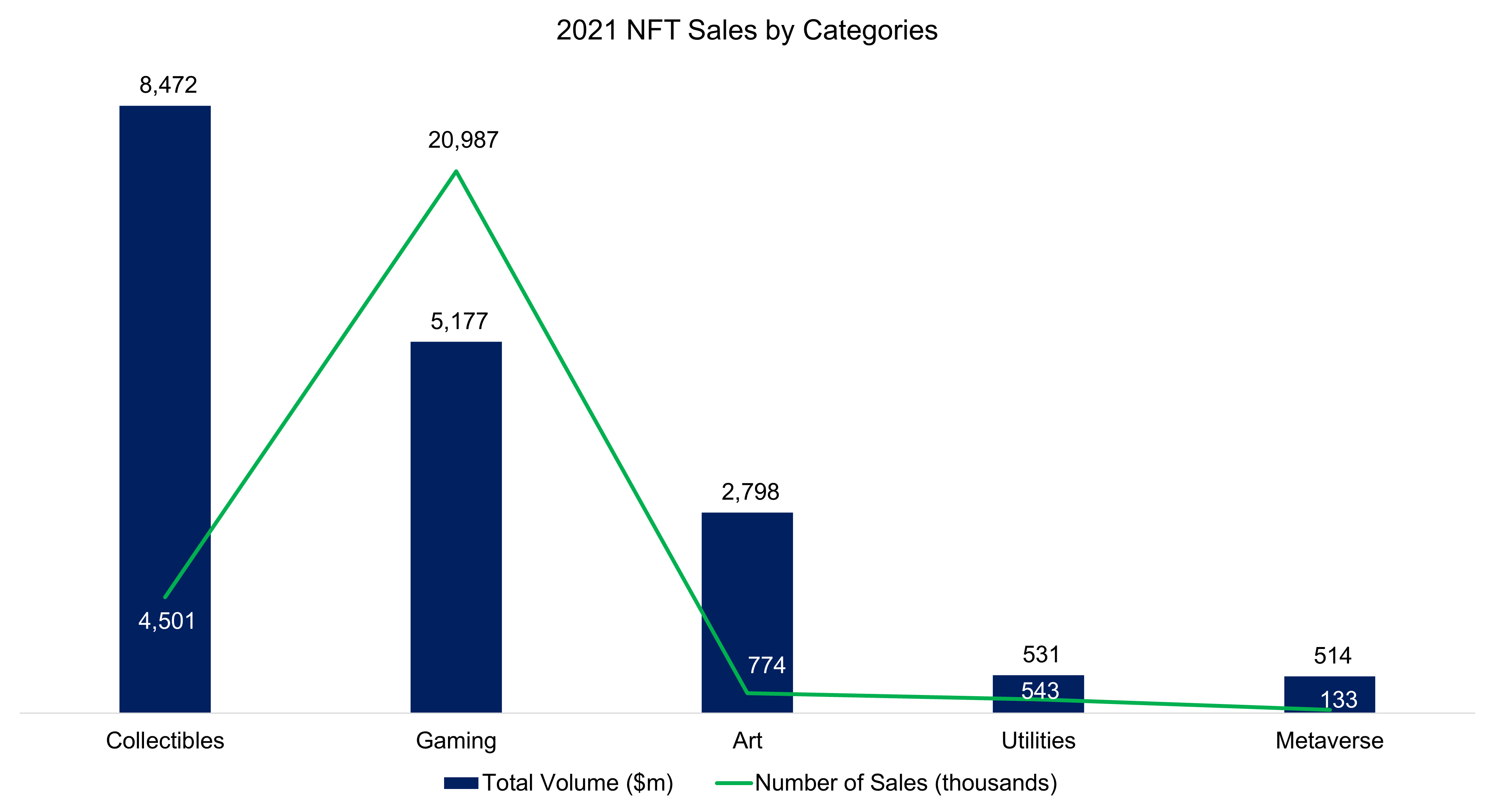

While there are multiple categories within the NFT ecosystem, 2021 was dominated by collectibles followed by gaming. A collectible is an asset whose main function is to be owned and displayed as part of one’s collection. The two flagship Collectibles projects of the year were undoubtedly CryptoPunks and Bored Ape Yacht Club. Crypto-Gaming was a part of the NFT landscape initially, but in 2021 it really took off, with the explosion of the “Play to Earn” trend.

Art comes third in the list in terms of total volume for 2021. Art was the spark that ignited the NFT industry, following the sale of Beeple’s “Everydays: The 5,000 First Days” in March 2021 for over $69m. While the numbers on Metaverse as a category might not be very high, but it undoubtedly generated the most interest towards the end of the year, thanks to the sensational announcement by Facebook (which became Meta) that it was starting to work on setting up its own Metaverse.

Source: Yearly NFT Market Report 2021 by NonFungible

NFT Marketplaces

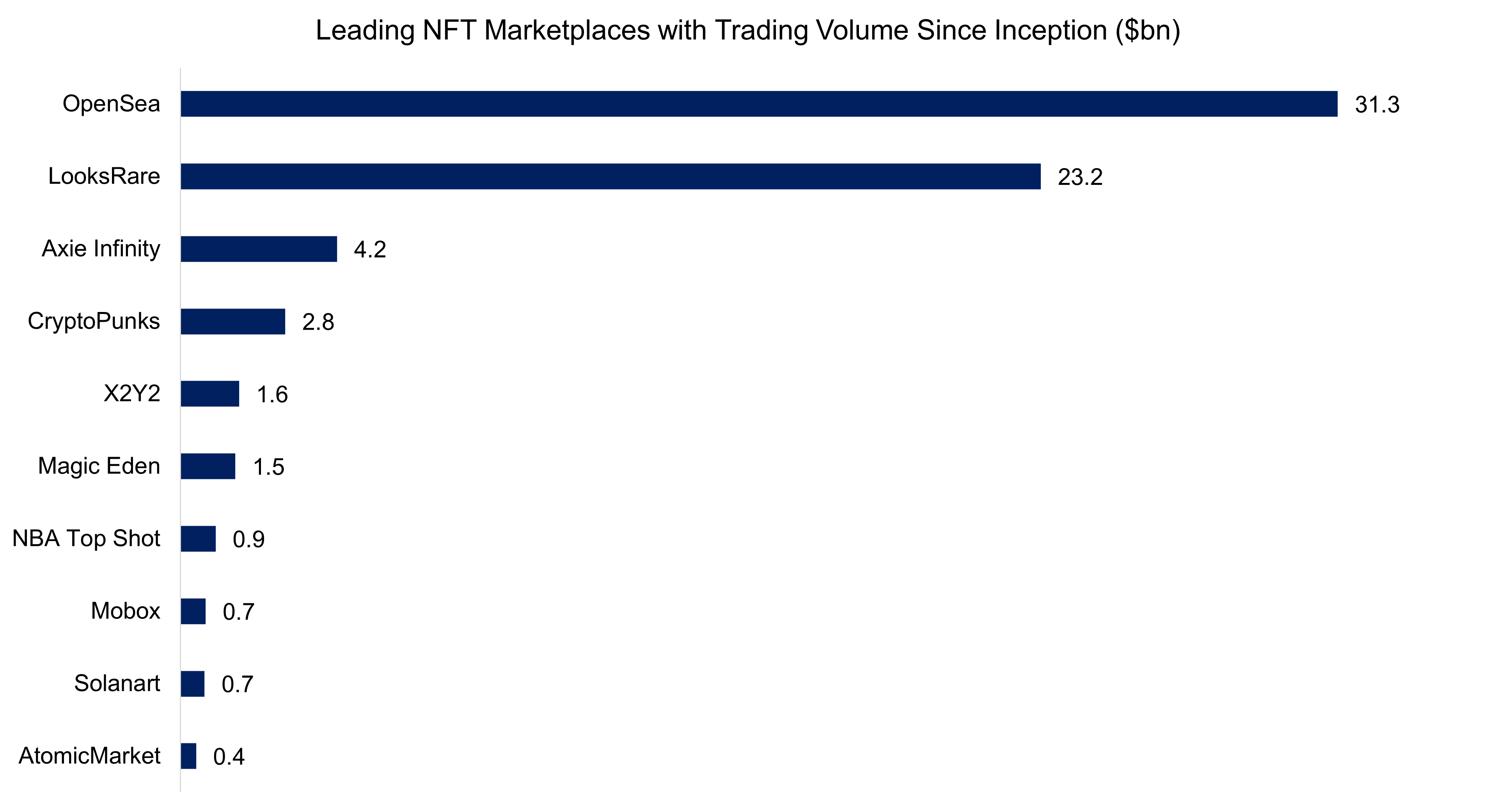

The surge & potential of the NFTs is made possible by the blockchain networks via NFT marketplaces. Founded in 2017, Opensea is a clear leader in the NFT marketplaces with 80m+ NFTs, 2m+ collections and 200+ employees. Second on the list is Looksrare, a decentralized, community-first NFT marketplace that actively rewards traders, token stakers, creators and collectors for participating on the platform. Clearly the market is dominated by the top 2 players which together have over 80% of the market share among top 10 players.

Source: DappRadar as on 24.06.2022

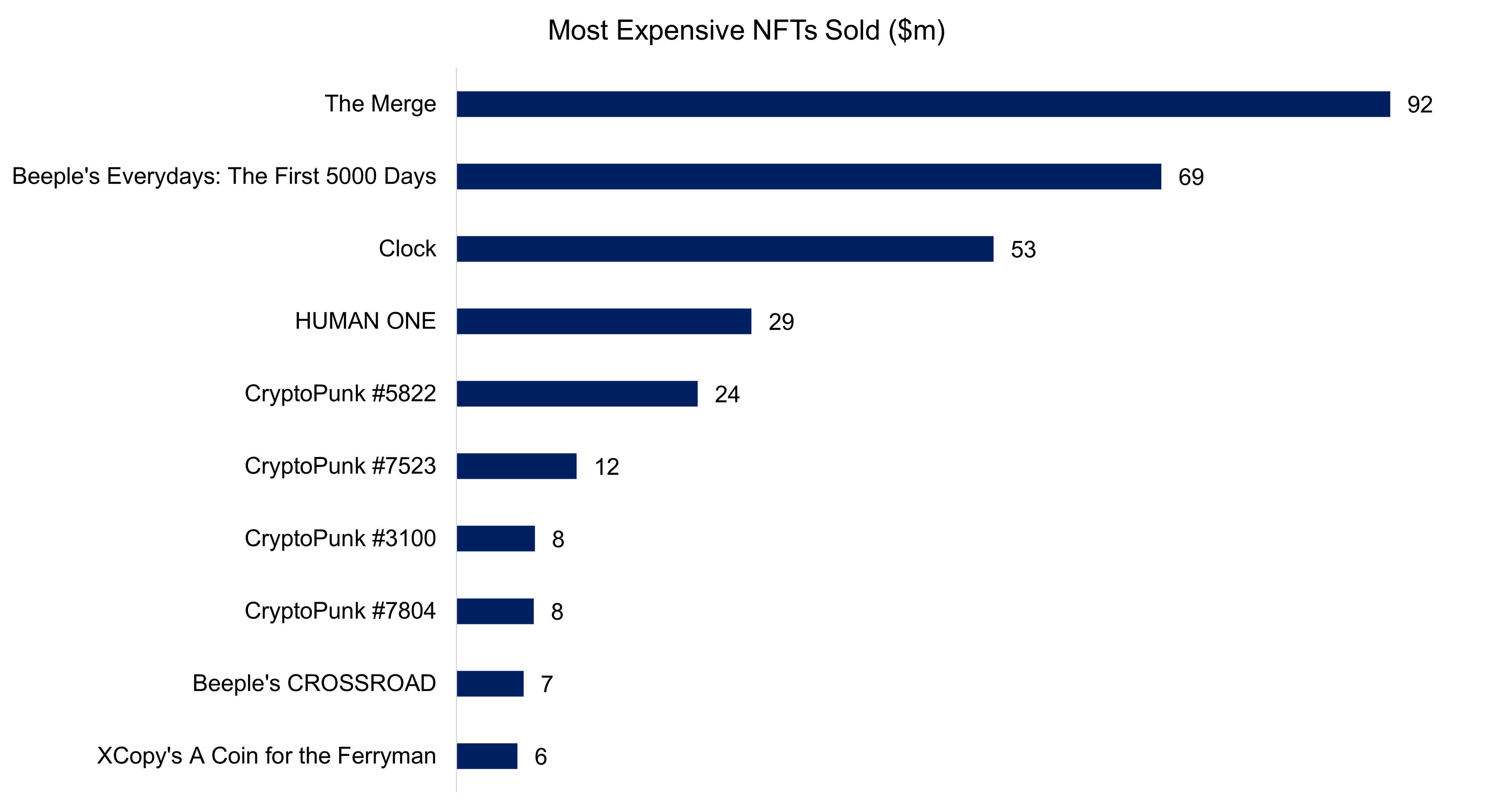

Most Expensive NFTs Sold

No rule books define how to assess the value of NFTs. Their value usually stems from the highest offer made by a bidder and is largely driven by perception. If a NFT is assumed to be rare, and the price would go up. But just as simply, if it is perceived to be common or ordinary, buyers will run away. Regardless, people all over the world have spent and continue to spend tens of millions of dollars on these digital assets today, let us dive into the top 10 biggest NFT sales to date.

Source: https://explodingtopics.com/

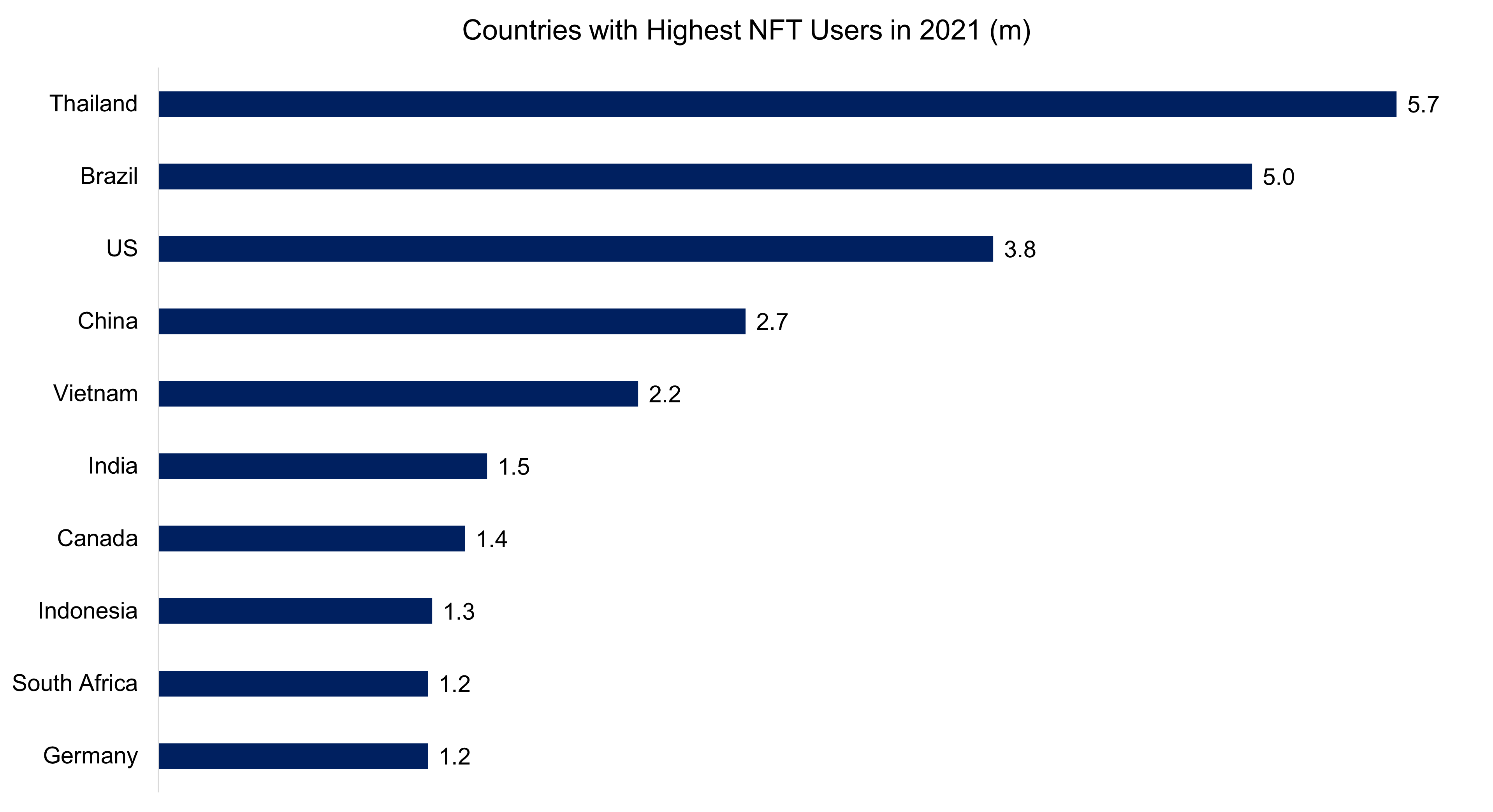

NFT Users by Country

Many believe that US would top the chart of most NFTs user by country but Thailand has the highest number of NFT users, followed by Brazil and the US. Even if the data is to be analyzed as population ratio, Thailand would still be top as 8.08% of its population own digital property. Overall, Asia has emerged as the frontrunner in the global NFT craze, with Southeast Asians making up most NFT-based web traffic.

This belief is further strengthened by insights from Metamask, a soft wallet with 21m users, which claimed that the Philippines is its single biggest market and Vietnam takes the third place with 32% of adults admitting to owning at least one NFT.

Source: Forbes

NFT Market in 2022: Fad or Future?

As the world embraces the metaverse, NFTs will become the thing to own. Owning an NFT would give people access to certain exclusive things in the metaverse, collectors can access unique and credible artworks in the form of NFTs from around the globe. While the data shows that the NFT market is behind its peak and since the onset of 2022, the numbers are falling in terms of unique buyers and sellers who participate in the NFT Market. It is important to note that as with all ground-breaking technology, there comes a “plateau of productivity”, a phenomenon outlined in Gartner’s hype cycle, which indicates a period of lesser interest following a period of considerable hype.

Source: https://nonfungible.com/ as on 24/06/2022

Further Thoughts

The recent crypto market crash has sparked a wave of fear, uncertainty and doubt throughout the industry. The future of many coins and crypto projects suddenly is now questioned and in no time, the tide has changed against the funding of new projects in this space. However, the technology behind all of this i.e., blockchain is here to stay and change the way many industries work.

The future of NFT depends on regulatory clarity which in turn would define their adoption among the masses. As per an article by Yahoo Finance, sources from inside the US Securities and Exchange Commission (SEC) told Bloomberg earlier in the year that US regulatory agency is keen to investigate illegal digital token offers and to see whether NFTs should be considered securities. NFT “1.0” was built on FOMO (fear of missing out), scarcity, and price appreciation. “NFT 2.0” is set to be about utility, value, innovation, and storytelling. As long as NFT providers and partners keep the customer experience at the center of their strategies, there seems to be a bright future ahead for the overall market.

About the Author