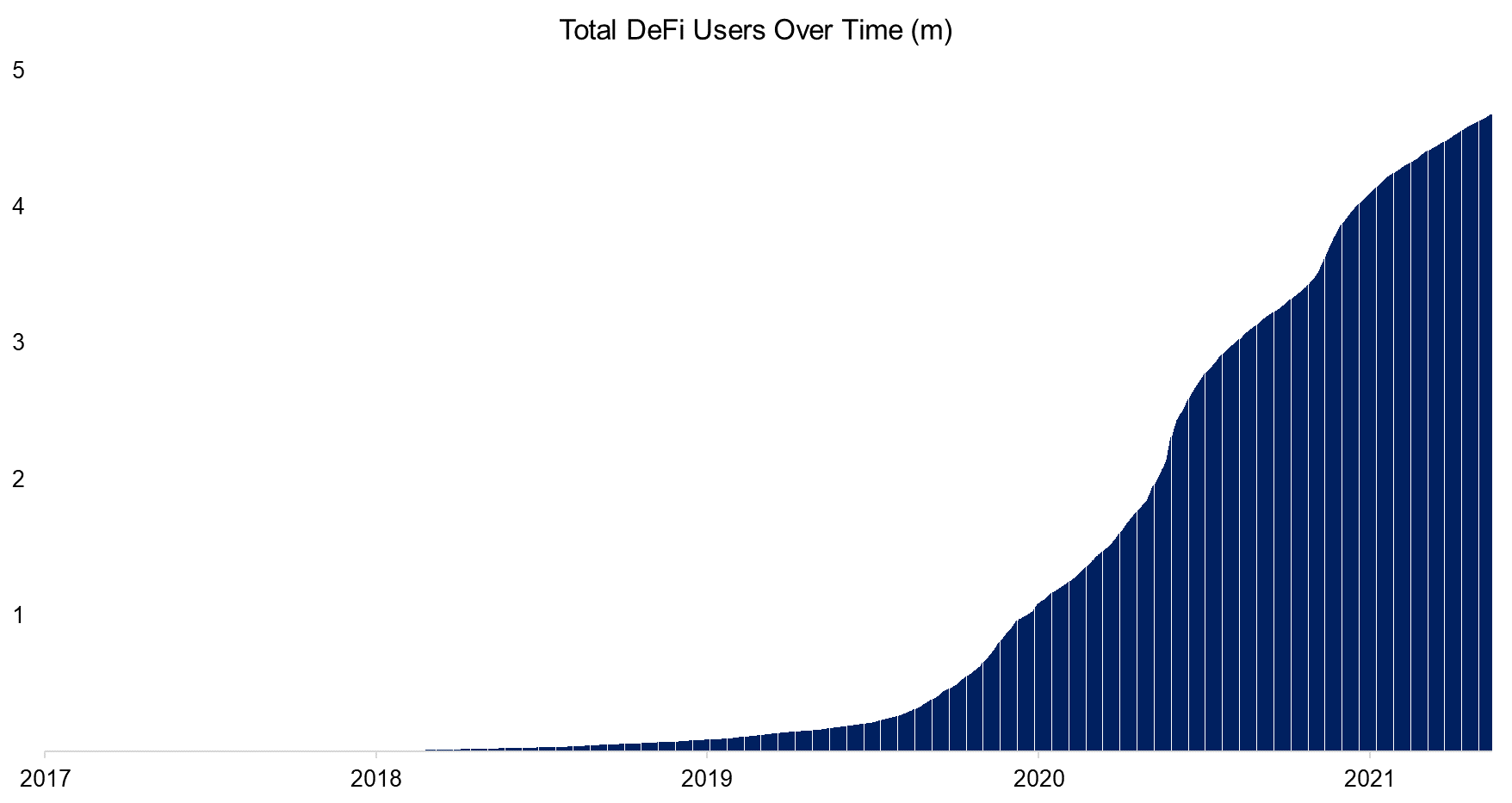

The number of DeFi users increased from 90k in 2019 to over 1 million in 2020.

May 2022. Reading Time: 10 Minutes. Author: Kaushik Ganesan.

Introduction

In February 2022, the Prime Minister of Canada, Justin Trudeau, invoked the Emergencies Act for the first time in Canadian history to freeze the bank accounts of protesting truckers. This event has made people question the power of traditional banks and their strong link to the government. Other events like the 2008 Global Financial crisis has shown the world how broken the most sophisticated stock market in the world was and not to mention the 2020 Gamestop’s short squeeze in which retail investors were blocked by Robinhood because of liquidity issues. The adoption of decentralized finance is increasing more than ever before as people see the power of centralization being misused and inefficient.

Decentralized Finance (DeFi) is the intersection of blockchain, digital assets, and financial services. DeFi leverages blockchain technology to facilitate financial services like lending, borrowing, insurance and much more. The DeFi protocols are built using smart contracts on the layer one blockchains.

In this article, we will explore various DeFi services.

Rise of Decentralized Finance

2020 was the foundational year for DeFi. The number of users increased from 90k in 2019 to over 1 million in 2020. According to Coingecko, the market capitalization went up from $1.8 billion to $21 billion. The number of decentralized apps has also grown by 29x. But why is 2020, more than a decade after the launch of Bitcoin, a special year for decentralized finance?

MakerDAO, a protocol that issues the stable coin DAI in exchange for ETH, was launched in 2017 and it is one of the first DeFi projects that laid the foundation for the DeFi ecosystem. ICOs became prevalent on Ethereum in 2017. In 2017 alone, ICOs raised a collective of $4.6 billion (up from $200 million in 2016) and the number of ICOs also went up from two projects in 2013 to 438 projects, according to PwC. The idea of people interacting with a piece of code (also called a smart contract) to collect funds is one of the main breakthroughs in DeFi.

There were no major breakthroughs in DeFi until July 2020, when Synthetix figured out a way to incentivize users by issuing the protocol’s native token to provide liquidity. As a chain reaction, Compound released its liquidity mining program in May 2020 which led to the creation of a governance token called COMP in Compound protocol. This model became widespread and all the DeFi projects started using this model.

Cryptocurrency Lending

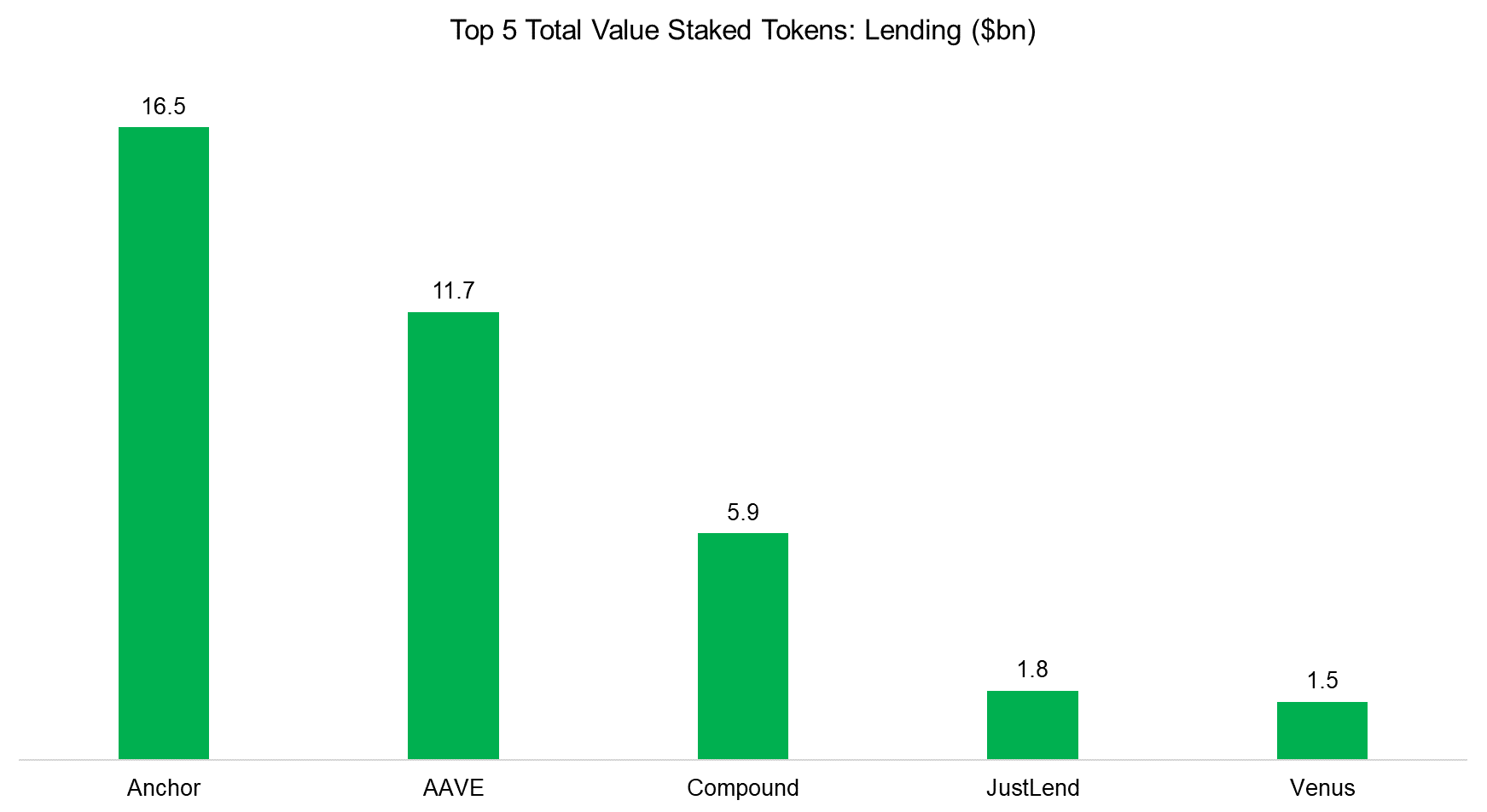

In DeFi, users can borrow and lend crypto assets for a fee or interest. The idea of lending is instead of keeping the crypto assets idle, one can deposit the crypto assets into platforms like Anchor, Aave, etc to earn interest rates much like fixed deposits. Anchor is one of the famous lending platforms that provide very high-interest rates for depositors and the total staked value of Anchor is more than $16 billion. The interest rate has hovered between 18%-23% for the last 1 year.

There are different revenue streams for investors in a DeFi protocol. In Compound, when funds are deposited, the protocol issues tokens called cToken which is like a receipt that shows the balance of the deposited amount. For e.g. if ETH is deposited, the Compound protocol will issue an equivalent cETH token. This cETH token can be used as collateral for a loan, meaning that the deposit can be used while the token is earning interest at the same time.

Unlike traditional banks, most lending platforms also reward users for borrowing money too. On top of this, users are also given governance tokens called COMP in Compound which can be used to vote on key decisions for the protocol, and these governance tokens can be sold for the market value.

Source: Jackdaw Capital, Defillama

Yield Aggregators

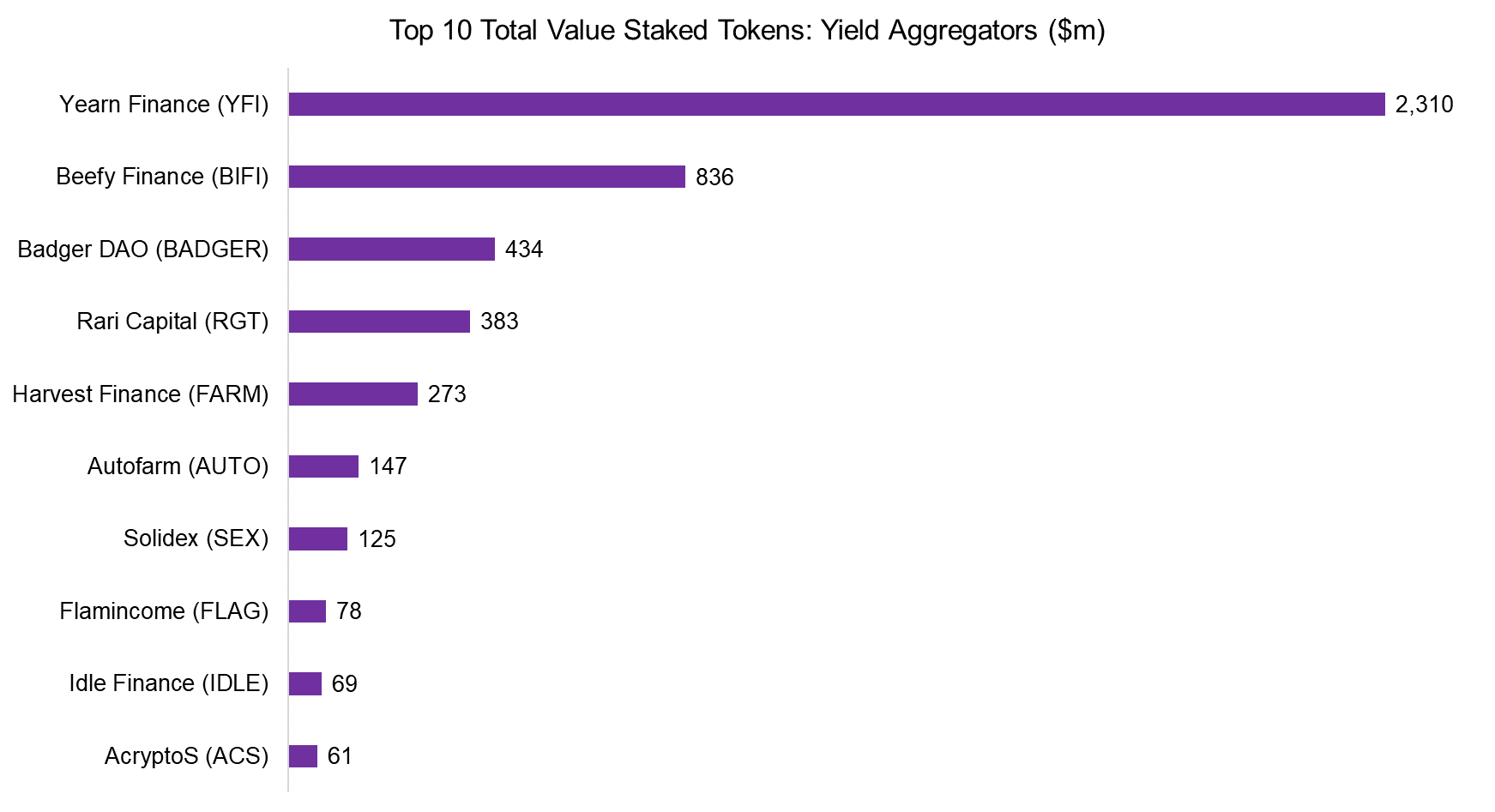

Yield Aggregators are like mutual funds whose primary job is to manage the basket of funds on behalf of the investors. Because yields vary between platforms, it has been difficult for the investor to find the opportunities at the right time. Yield Aggregators automate the crypto investments to earn the highest yield from various platforms to find the best deals to maximize profit for the user, thereby simplifying the user experience.

Yearn Finance is one of the pioneers in automated financial services and it leads the space by a large margin. It aggregates DeFi lending platforms such as Aave, Compound, and various other DeFi protocols. Unlike the traditional finance world where it’s difficult to aggregate all possible investments and maximize the result, it’s simpler to aggregate all possible investment opportunities in one place because DeFi protocols communicate in one language called programs.

Source: Jackdaw Capital, Defillama

Blockchain Bridges

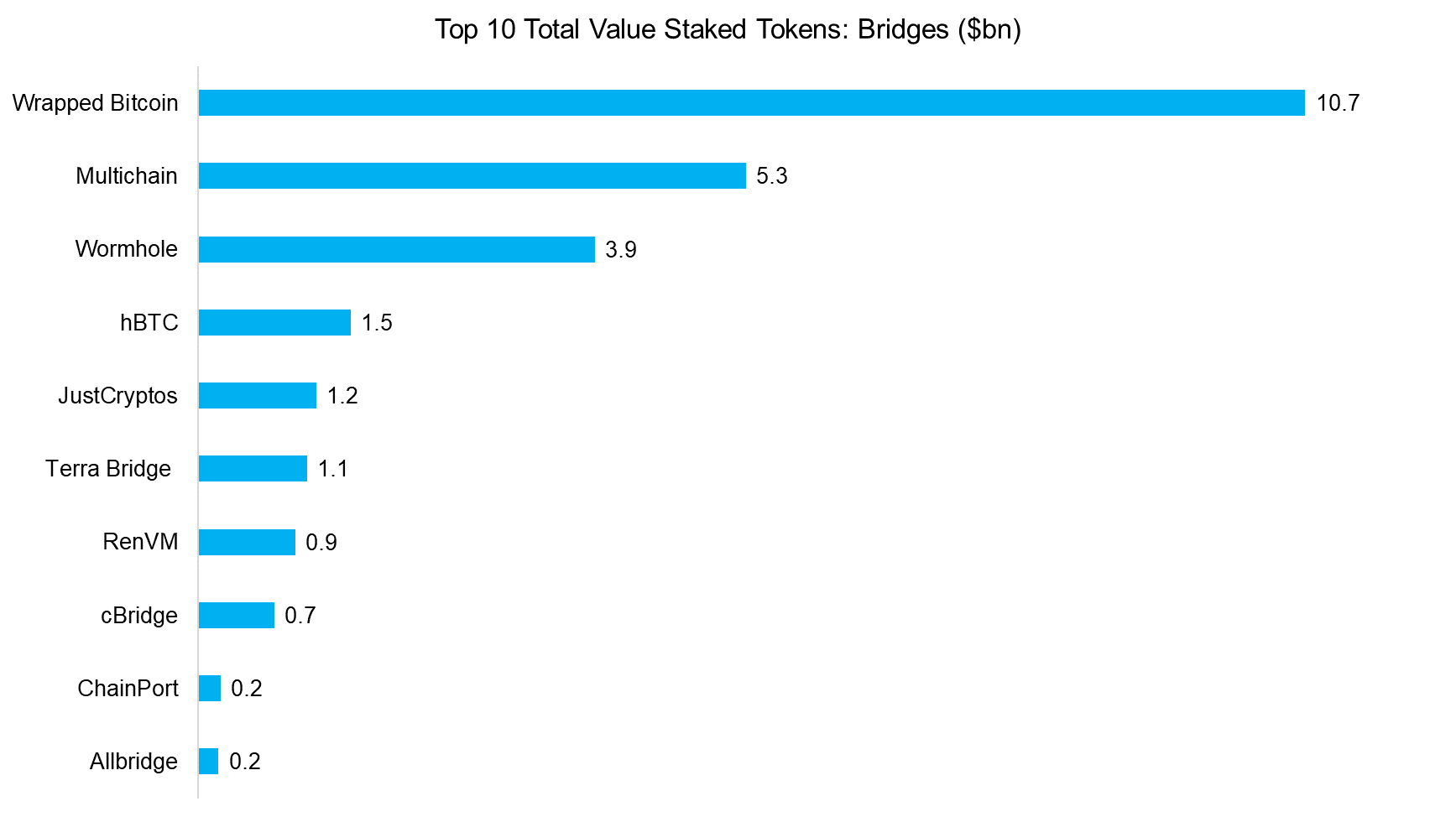

Like how stable coins are pegged to a fiat currency, wrapped tokens are pegged to a cryptocurrency. Blockchain bridges help investors exchange a token from one blockchain to another blockchain. For e.g., Wrapped Bitcoin derives its value from bitcoin i.e. 1wBTC = 1BTC but can be used on other blockchains like Ethereum, Solana, etc.

High market capitalization and widespread adoption of Bitcoin and Ethereum by the crypto community is what makes Wrapped Bitcoin, the most used wrapped token. Like other Ethereum tokens, Wrapped Bitcoin is an ERC-20 token that is built on the Ethereum blockchain to facilitate Bitcoin holders to transfer money to the Ethereum blockchain quickly.

Interoperability and leveraging functionalities of other blockchains are some of the advantages of using wrapped tokens. For e.g. transaction speed in Bitcoin is slow compared to Solana or Ethereum. So, to move Bitcoin faster, convert Bitcoin to wBTC and do all transactions on the Ethereum blockchain. Also, wBTC can be used as collateral or to participate in other DeFi activities in the DeFi protocols such as Aave, Compound, etc which can be used only using ERC-20 tokens.

Source: Jackdaw Capital, Defillama

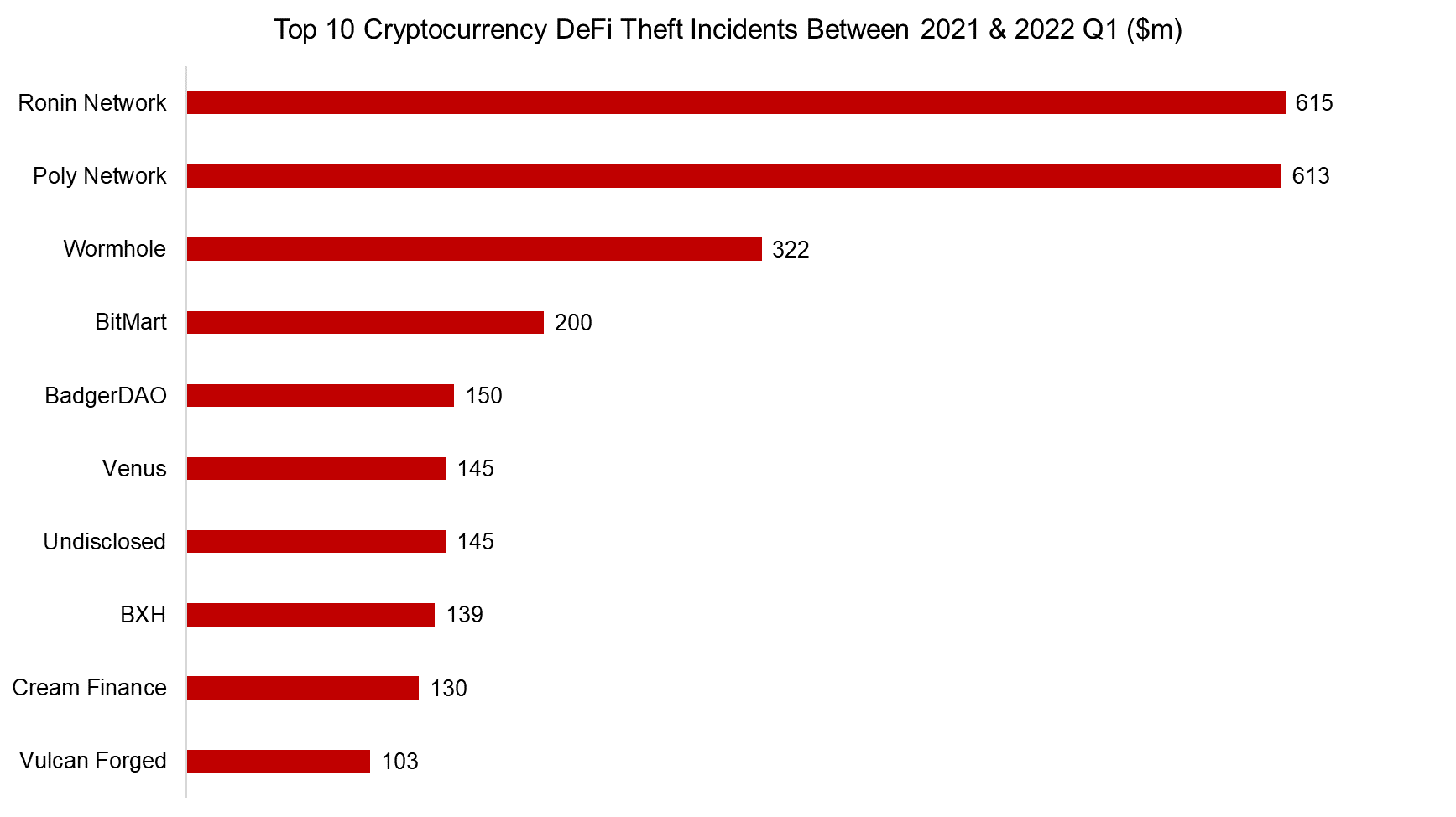

DeFi Thefts (2021-2022 Q1)

A total of $2.6 billion worth of DeFi crypto assets have been stolen since 2021. A large number of hacks in DeFi are caused by faulty code and breaching the security of the network.

- In the case of the Ronin network, it was a security hack. The attacker got access to five of the nine validator nodes. With the majority access, the attacker forged the transaction and claimed 173,600 WETH (Wrapped Ethereum) and 25.5 million USDC, totaling over $615 million.

- In the case of Poly network, it was a faulty code in the Poly Network’s smart contract. The attacker found a vulnerability in the smart contract calls and made over $613 million with various crypto currencies.

Further Thoughts

Decentralized finance is slowly evolving in terms of security and cost standpoint. The goal to eliminate the middleman in finance is efficient until one realizes it comes with a huge security concern. Most of the security concern comes from faulty code which can be easily resolved by stress testing the code and vetting the code through various predefined security checks.

There are a lot of DeFi projects that promise high APY and various benefits to attract more investors to create liquidity. Evaluating the intrinsic value of a token and the tokenomics of the yield-providing platforms has become essential to avoiding short-term traps. For e.g, the famous anchor protocol isn’t generating enough income to pay an 18% rate. It’s been paying the investors by burning its reserves. Because there is more demand for an 18% yield than there is demand from borrowers for Terra coin in Anchor, there is an imbalance in the Achor protocol. If this continues, Anchor protocol might burn its reserves and eventually go out of business.

About the Author

Kaushik Ramnath Ganesan is a Technology Investment Analyst at Jackdaw Capital. He comes from a computer science background and completed the CQF (Certificate in Quantitative Finance) program. At Jackdaw Capital he applies computer science, finance, and mathematics to bring blockchain technology mainstream.