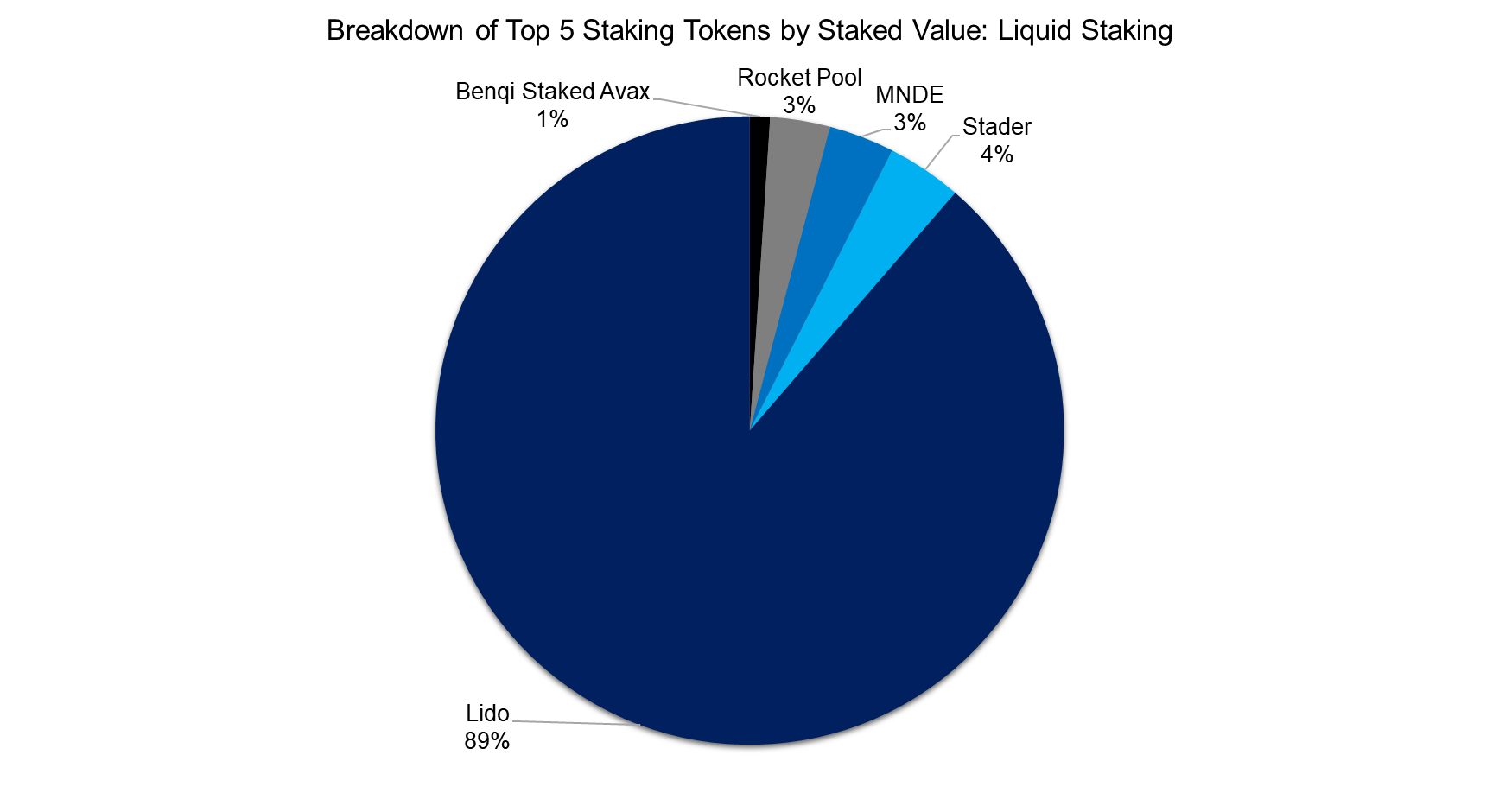

Lido has an 89% market share in the liquid staking category

May 2022. Reading Time: 10 Minutes. Author: Kaushik Ganesan.

Introduction

Staking is a term that has historically been associated with providing upfront capital to a player in a game like poker. If the player wins, 50% of the profits go to the investor, and 50% to the player.

However, over the last couple of years, staking has been more frequently associated with the cryptocurrency space, where staking represents the act of locking crypto assets in a blockchain network to become a validator. The validator’s role is to validate the transactions and secure the network, i.e. they can be viewed as the auditors of the blockchain space. For their service, validators are paid with staking rewards.

In this article, we will explore different types of staking and its rewards.

Consensus Mechanism: Proof-of-Work and Proof-of-Stake

The proof-of-stake (PoS) mechanism is designed to ensure the security and integrity of the blockchain network by incentivizing the validators for validating transactions. All the rules are programmatically defined in the protocol. Validators who break these rules by behaving abnormally on the network would lose a predefined percentage of tokens staked in the network. This mechanism to discourage validator misbehavior is known as slashing.

Proof-of-work (PoW) allows anyone to become a validator by solving cryptographic puzzles, aka “mining”. Whoever solves the cryptographic puzzle first has the right to validate the transactions and collect the fees for securing the platform. The main criticism of PoW is that it consumes a lot of electricity as many people are trying to solve the same puzzle. Bitcoin, which is based on a proof-of-work mechanism, consumed as much energy as Austria in 2020.

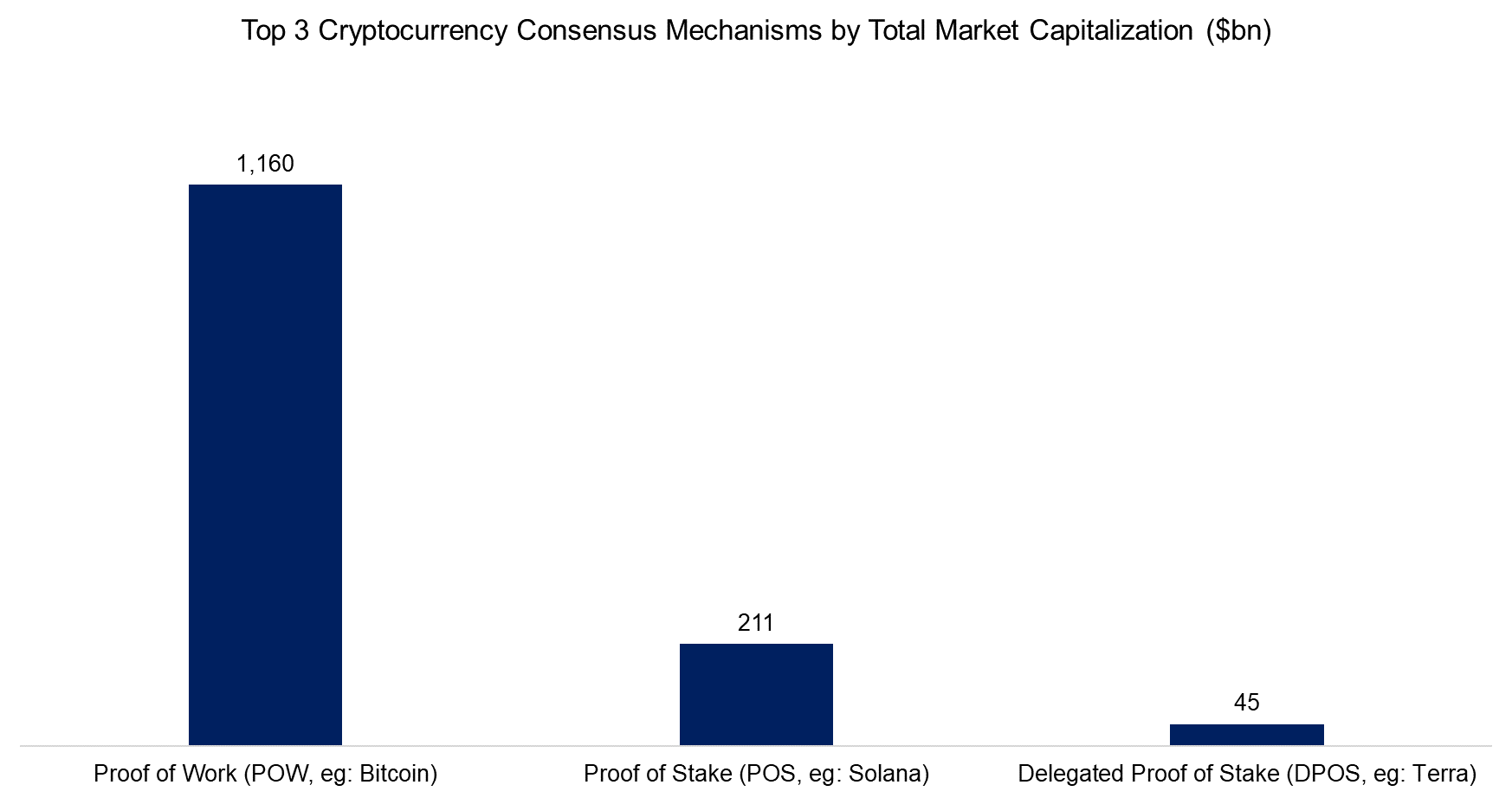

The market capitalization of PoS blockchains has increased from approximately $9 billion in October 2019 to over $211 billion as of April 2022. Although the market capitalization of PoW is significantly higher at $1.2 trillion, most of this can be attributed to the two largest blockchains namely Bitcoin and Ethereum. Once Ethereum 2.0 is launched, where the blockchain will move from PoW to PoS, the total market capitalization of each will be more similar. From a number’s perspective, the distribution is almost the same with 280 cryptocurrencies using PoS and 354 using PoW as their consensus mechanism, according to CryptoSlate.

Source: Jackdaw Capital, CryptoSlate

Cryptocurrency Staking

There are multiple ways to pursue staking for someone interested in earning some money. The most direct approach is to do this directly at the blockchain layer, which is also called layer one, e.g. depositing money into the Solana blockchain. However, staking at layer one is only possible for PoS and not PoW blockchains like Bitcoin. Ethereum is somewhat unique in that it is a PoW currently in the main network, but the PoS mechanism is running on a separate chain called the “Beacon chain” where staking is possible. When the Beacon chain merges with the main chain, PoW will be removed entirely from the Ethereum main network.

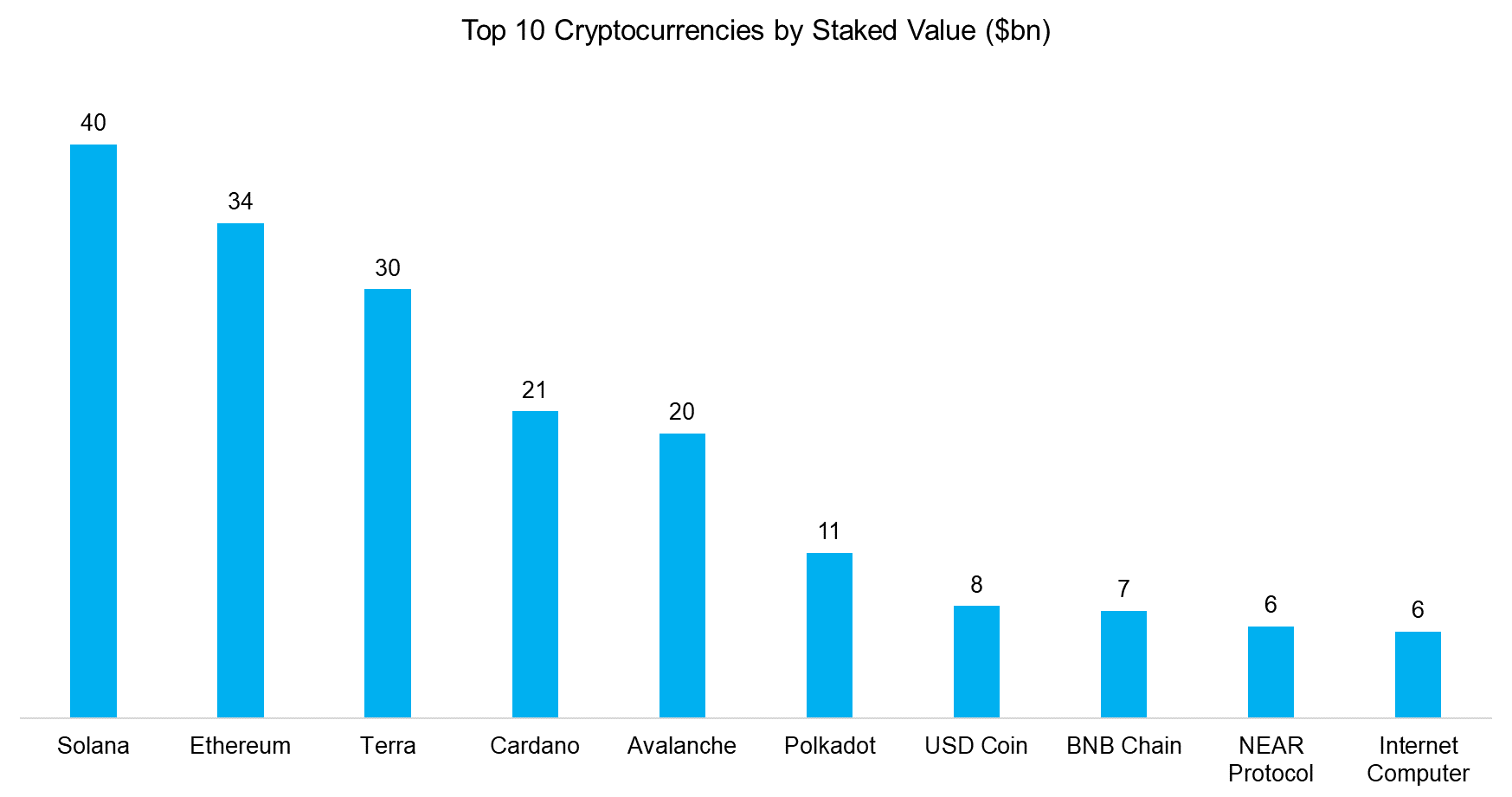

The total staked value of all the PoS cryptocurrencies is $266 billion currently, where Solana and Ethereum dominate with a 28% market share. The staked value changes daily as people withdraw from or stake more money in the networks.

It is worth highlighting that some blockchains have minimum requirements to start staking and becoming a validator, e.g., one must deposit at least 32 ETH tokens in the Ethereum blockchain. In contrast, the are no minimum SOL tokens to run a validator node in the Solana blockchain.

Source: Jackdaw Capital, Staking Rewards

Liquid Staking

Liquid staking is an alternative to staking directly in the blockchain protocol that involves complex steps like setting up hardware for validating transactions and maintaining the validator node but is offered by third parties that make a business out of staking. Essentially, the startups make staking easier as they manage the process and also require lower minimum investment amounts. However, they also charge for their services and so the yield is lower than if done directly.

Lido is by far the largest liquid staking platform with approximately $18 billion of staked value, followed by Stader with a mere $789 million. According to Etherscan, Lido alone accounts for 30% of the depositors in the Ethereum protocol. Other custodial providers like Kraken and Whales account for about 8.5% and 8.3% of the depositors, respectively.

Lido issues stETH in return for staking any amount of Ethereum. stETH is pegged to ETH and it can be used to lend, borrow, and pool using other platforms. For e.g., Aave, a lending platform in the crypto space, allows users to borrow against their stETH. On Lido, the current APR for Ethereum is 3.6% and 5.3% for Solana.

Centralized Exchanges Staking

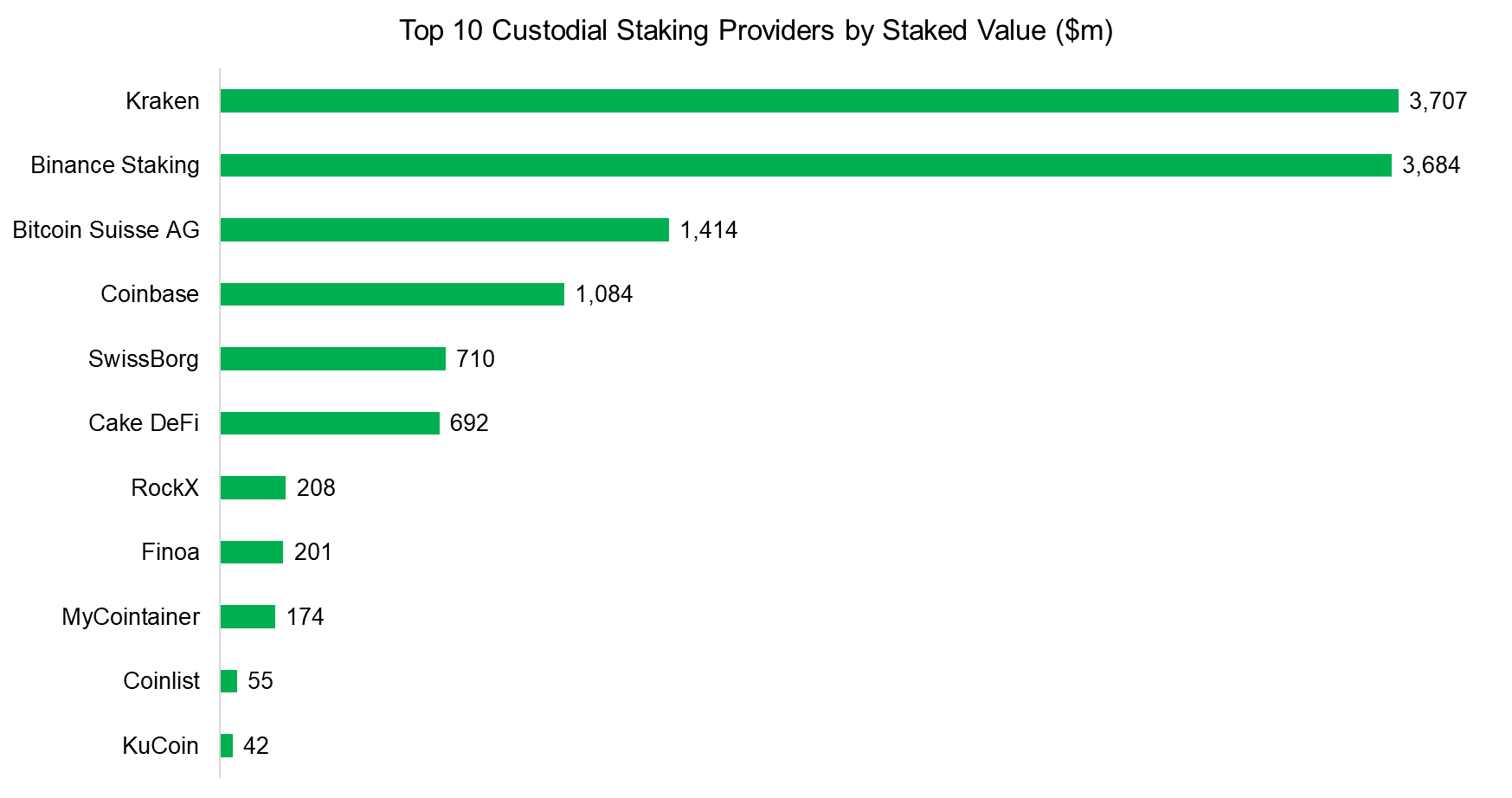

Staking in centralized exchanges is like depositing money in a bank account and the banks take care of the account. With this option, one doesn’t need to create a wallet separately or hold private keys for the wallet. This is simpler compared to staking directly in the blockchain, but the staking rewards from the centralized exchanges are lower as these charge fees.

Kraken and Binance have the largest market share in this category and manage $7.4 billion worth of staked value. In contrast, the popular US crypto exchange only manages $1 billion. However, when combining both centralized and decentralized exchanges that offer staking as part of their services, eight out of the top ten were decentralized exchanges. The largest ones are Everstake ($4 billion), Allnodes ($3 billion), and InfStores ($3 billion).

Source: Jackdaw Capital, Staking Rewards

Staking Rewards

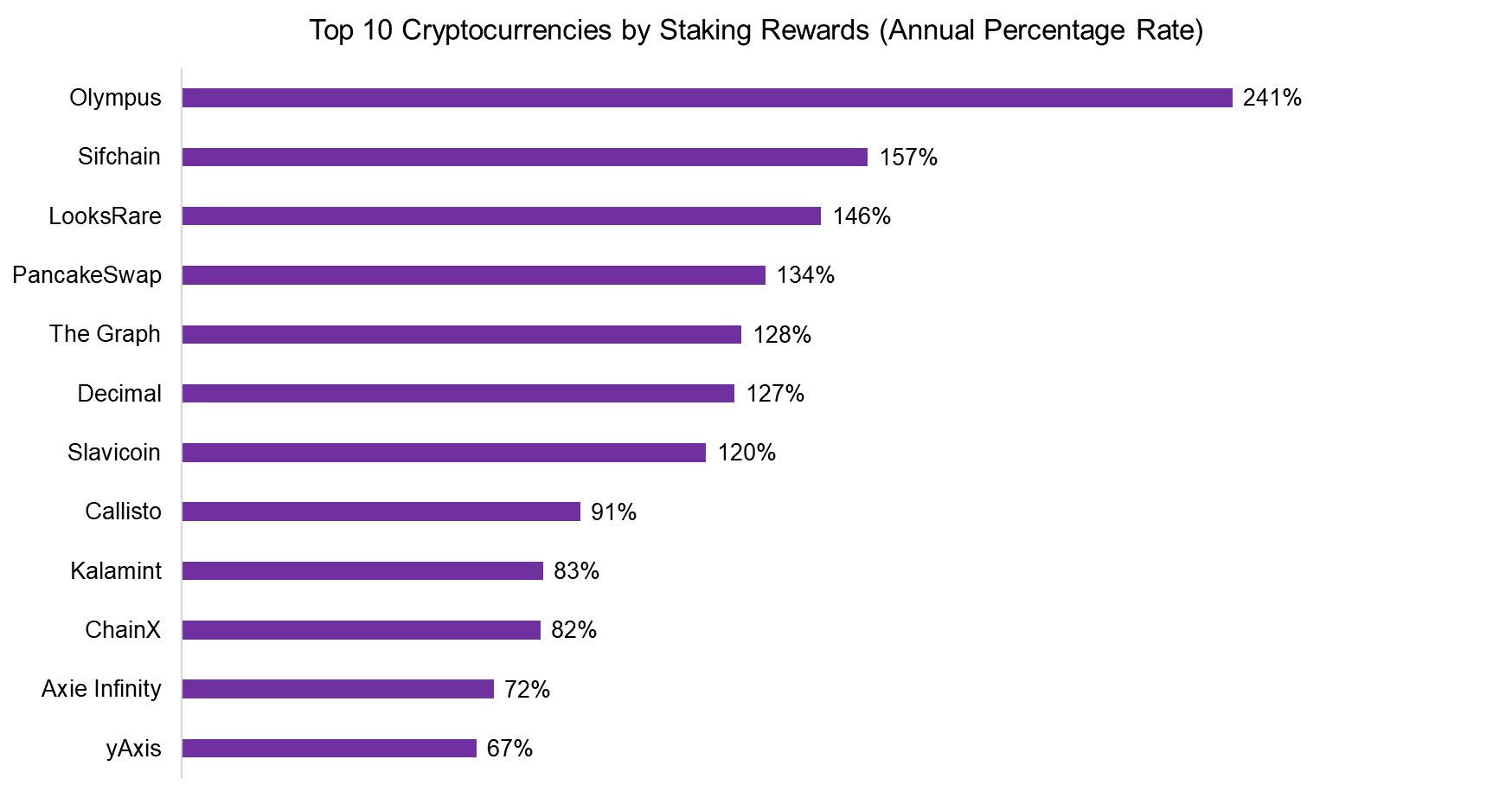

Staking reward is the incentive given to validators for spending computing power to validate a block of transactions in a blockchain. But this is different from staking in DeFi protocols like Olympus or Pancakeswap. The process of lending crypto assets and earning interest for providing liquidity on DeFi protocols is known as yield farming.

Staking rewards are almost irrelevant if the price of the token does not go up. For e.g., if the staking yield is 10% and the token supply is also 10% per annum, in real terms, there is no gain unless the price of the token is higher than the initial price. And therein lies the issue as most protocols calculate staking rewards using the supply inflation of the token.

One important thing to note about staking is that annual percentage yield (APY) decreases over time as the number of total staked values increases in the protocol. For example, at an early stage, the APY for staking in Ethereum was 23%, but as the total staked value increased to more than $30 billion, the APY decreased the APY to around 3%.

Some tokens offer exceptionally almost absurd yields compared to the meager ones from the traditional finance space. Olympus’s APY was 7,320% in October 2021, which implied investing 1 OHM (Olympus token) would have generated 73 OHM tokens per annum. Since then, the number of OHM holders has increased from 12k in October 2021 to 82k in May 2022, which decreased the APY to 476%.

Further Thoughts

The quantitative easing programs of the world’s central banks have generated a gigantic thirst for yield that can be seen across all asset classes. In 2022, the demand for yield has increased as inflation has spiked and most investors are incurring negative real returns. Anyone in the US with cash in their bank account is losing money in real terms currently.

It is easy to see how the attractive yields from staking have created interest for all investors, and not just crypto enthusiasts. However, high yield comes with high risk, which is often overlooked by yield-hungry investors. In the case of staking, this means getting a yield and holding tokens that have price risk. Getting a 10% yield is not attractive when the token exhibit high price volatility, as that can quickly turn into a loss from a total return perspective. As usual, there is no free lunch.

About the Author

Kaushik Ramnath Ganesan is a Technology Investment Analyst at Jackdaw Capital. He comes from a computer science background and completed the CQF (Certificate in Quantitative Finance) program. At Jackdaw Capital he applies computer science, finance, and mathematics to bring blockchain technology mainstream.