March 2022. Reading Time: 10 Minutes. Author: Kaushik Ganesan.

Introduction

In February 2022, the Prime Minister of Canada, Justin Trudeau, invoked the Emergencies Act for the first time in Canadian history to freeze the bank accounts of protesting truckers. This event made people start questioning the power of centralization and how one persons’ decision can affect a lot of people. Are democratic countries really democratic in nature?

As people see the power of centralization being misused, the adoption of bitcoin and other cryptocurrencies is likely going to increase as keeping some portion of your money out of the government’s control may seem sensible going forward.

However, the world of cryptocurrencies is a complex one. There are coins and tokens, and only a few like Bitcoin or Ethereum are well-known.

In this article, we will provide some data points for comparing cryptocurrency coins versus tokens.

Tokens are increasing

Let’s get the terminology clear first: A coin is a native token of a blockchain. For example, “ETH” is the native token of the Ethereum blockchain. A non-native token is built on top of an existing blockchain, e.g. “USDT” or Tether is a token that is built on Ethereum. Anyone can issue a token and try to convince people to become investors in the token by buying it.

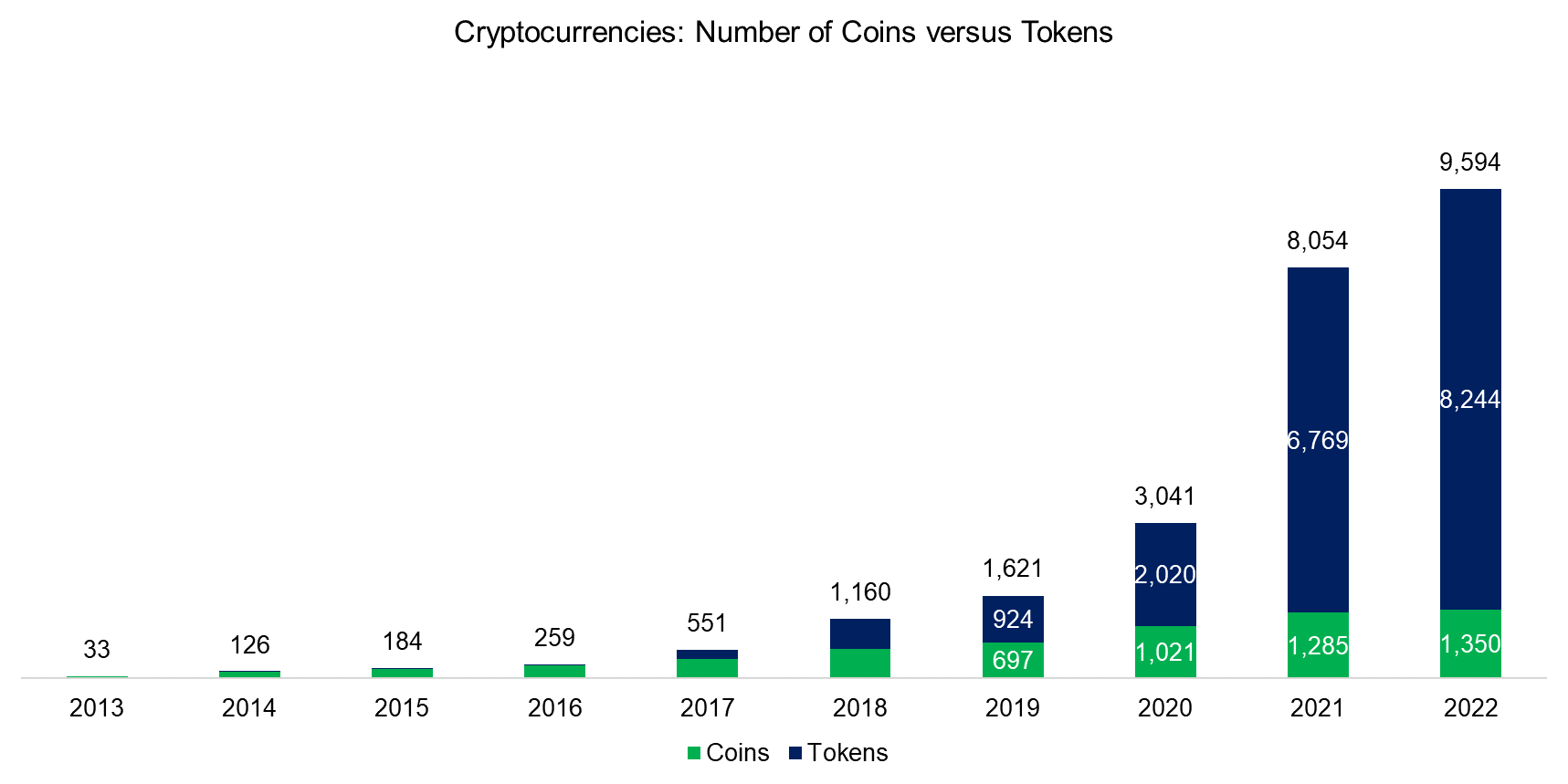

In the early years of the cryptocurrency space, there were only coins. However, during the first digital asset boom in 2017, this changed as many tokens came to the market via an initial coin offering (ICO). The number of tokens has been increasing rapidly since then and today there are significantly more tokens than the roughly 3,000 US stocks.

Source: Jackdaw Capital, CoinMarketCap (March 2022)

Breakdown by Market Capitalization

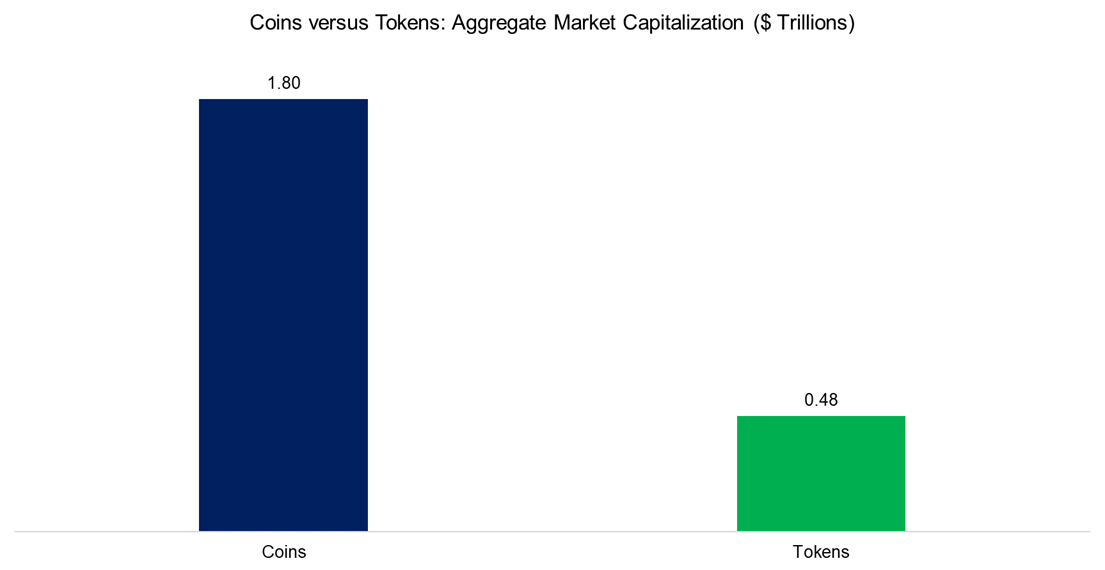

Although the number of tokens multiples is higher than the number of coins, the latter dominates in terms of value. The combined market capitalization of coins is $1.8 trillion, compared to a mere $480 billion for tokens. It is worth highlighting that Bitcoin and Ethereum contribute 42% respectively 18% of the total coin market capitalization.

Could a token have a larger market capitalization than the native coin of a blockchain? Theoretically yes, but there is no token in the top 30 by market capitalization that has achieved that.

Source: Jackdaw Capital, CoinMarketCap (March 2022)

Breakdown by Token Blockchains

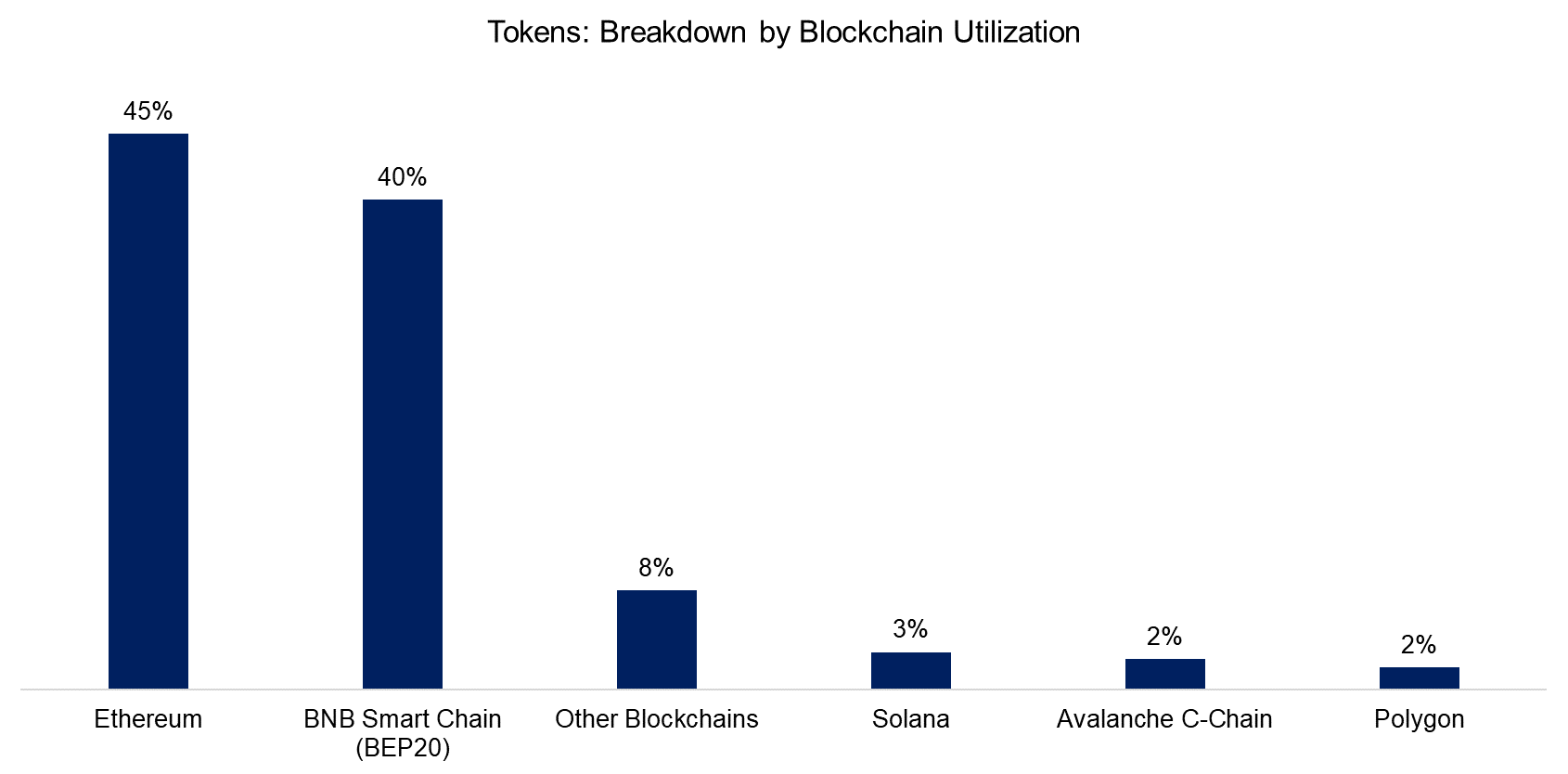

Next, we analyze which blockchains are most frequently used for token projects. We observe that Ethereum and BNB Smart Chain dominate with 45% and 40% utilization. Other blockchains like Solana or Flow are frequently mentioned in the media, but have a fairly small market share, despite offering quicker transaction speed and lower transaction costs than Ethereum. BNB Smart Chain is not well known in the Western world, but is the dominant chain in China.

Source: Jackdaw Capital, CoinMarketCap (March 2022)

Number of Market Pairs

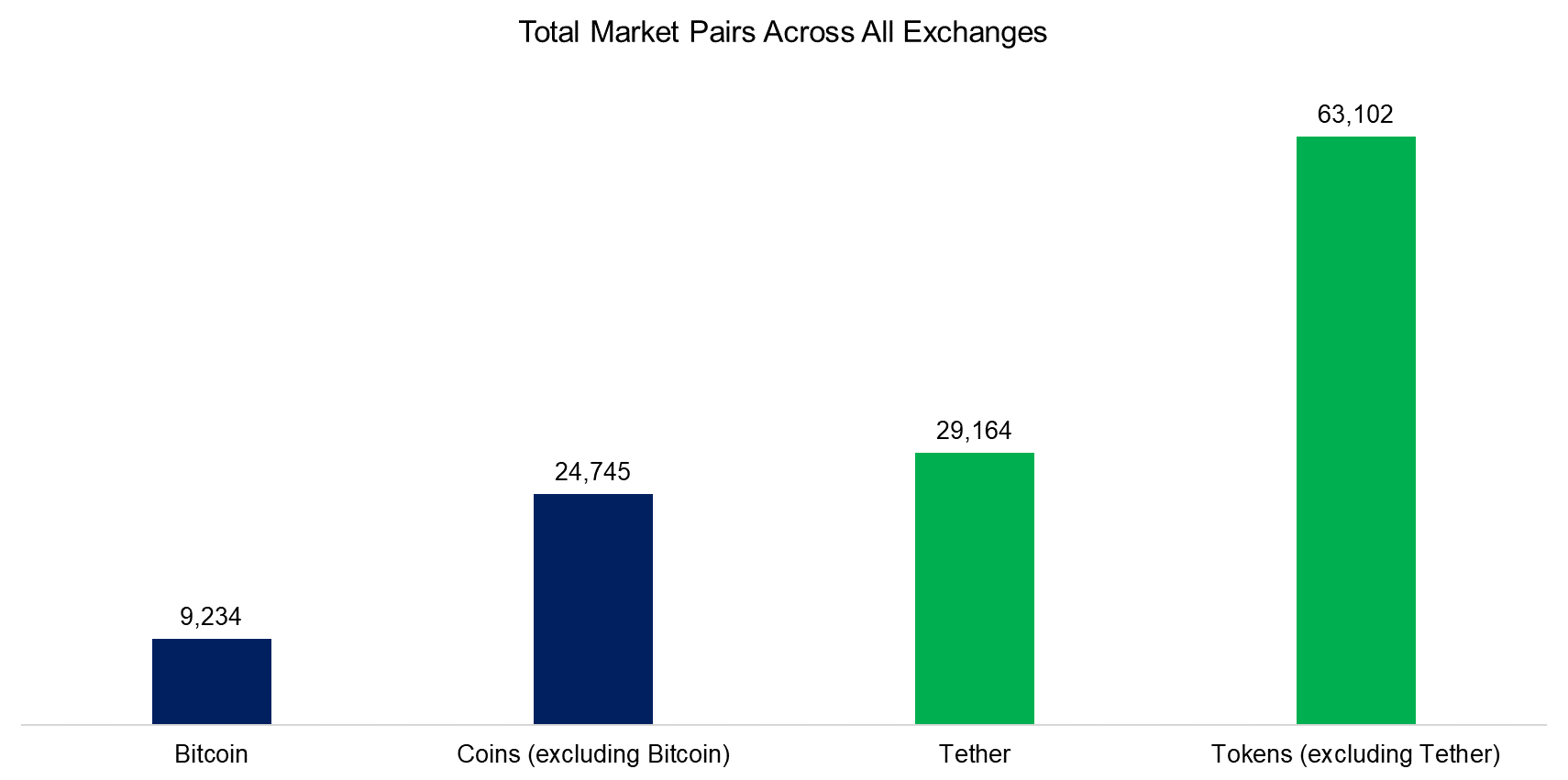

Trading a coin or token is different from trading a stock as it is trading pairs, eg Bitcoin against the USD. Given this, the number of market token pairs traded across all exchanges is larger than those of coins pairs. Unsurprisingly Bitcoin (9,234) has the largest number of pairs, followed by Ethereum (5,560), and Binance Coin (749). Tether leads the number of token pairs with 29,164, more than thrice the Bitcoin pairs. But why?

Tether is a stable coin and its price is pegged to the USD, ie one USDT is one USD. Compared to Bitcoin, USDT has practically zero volatility and is used by most crypto investors for holding the equivalent of cash. It forms the base currency for any cryptocurrency speculation and is reflected in Tether having twice the 24h-trading volume of Bitcoin. Stated differently, Tether is the backbone of liquidity in the crypto market.

Source: Jackdaw Capital, CoinMarketCap (March 2022)

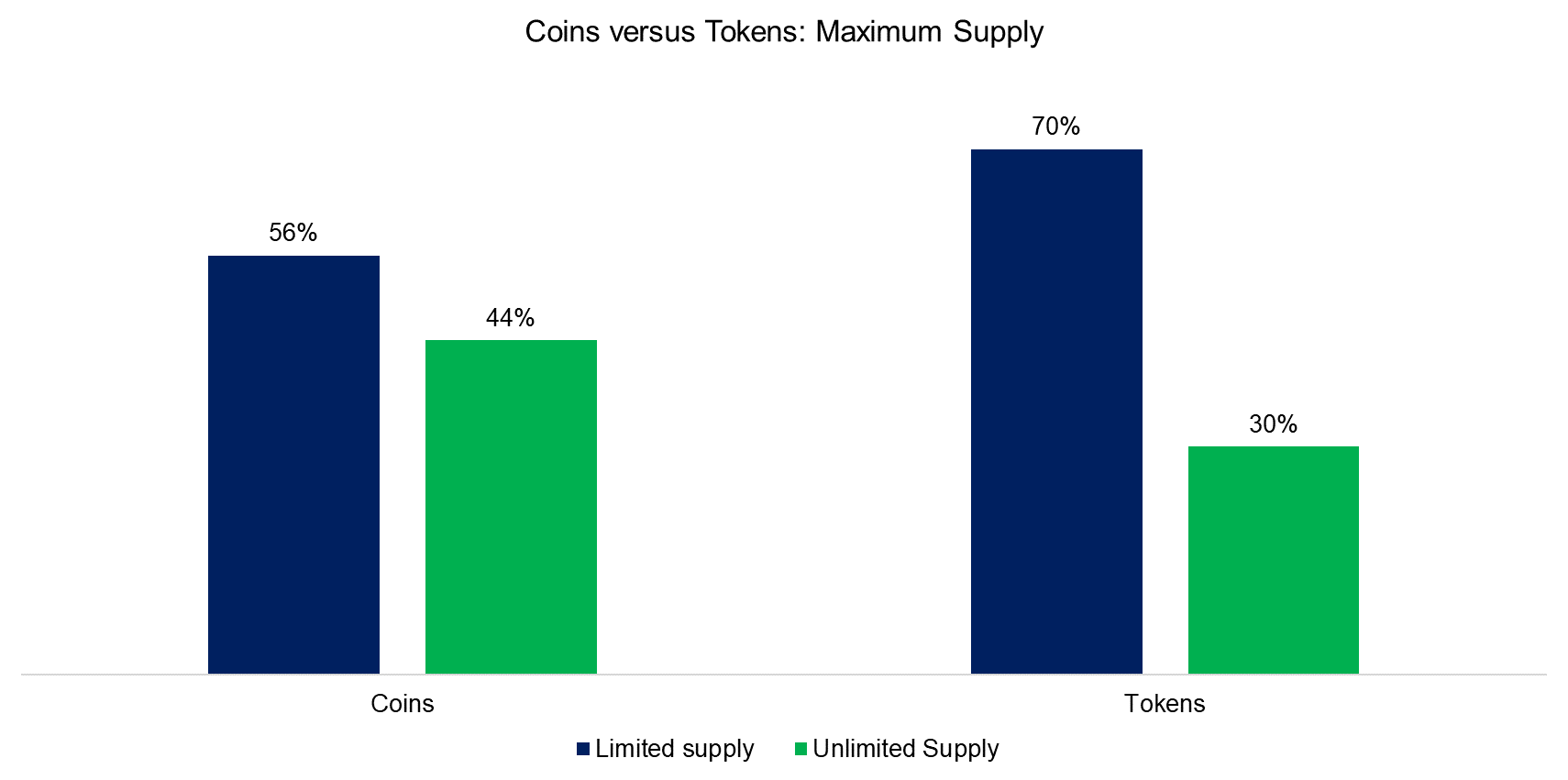

Maximum Supply of Coins and Tokens

Unlimited supply means that theoretically an infinite amount of coins or tokens can be created, which should be inflationary over the long term. Ethereum has an infinite supply and should decrease if we assume constant demand. Limited supply, like for Bitcoin, implies the inverse and should be deflationary.

However, the goal of all coins and tokens is an increasing demand, so an unlimited supply is not negative per se. Furthermore, coins and tokens can be taken off the market and burned, which acts deflationary.

The majority of coins and tokens have limited rather than unlimited supply. Although this is not strictly required for an increasing price, most investors view this as a favorable characteristic when considering a coin or token investment.

Source: Jackdaw Capital, CoinMarketCap (March 2022)

Further Thoughts

Although the blockchain space is new and rapidly evolving, there are a lot of similarities to traditional asset classes. Similar to a few companies like Apple or Amazon dominating the performance of stock markets, a handful of coins drive the performance of the cryptocurrencies.

Considering this also provides a roadmap for cryptocurrency investors. One implication is that alpha might still be available, but will ultimately be arbitraged away. A second one is that most investors are likely better off to pursue an indexing rather than active management strategy. A third one is that fees matter. The wild west of the investing world may not be so wild after all.

About the Author

Kaushik Ramnath Ganesan is a Technology Investment Analyst at Jackdaw Capital. He comes from a computer science background and completed the CQF (Certificate in Quantitative Finance) program. At Jackdaw Capital he applies computer science, finance, and mathematics to bring blockchain technology mainstream.